Hello,

Here we share what BudgetEase is seeing, ways we've found to help each other, and how we can help bring the economy back. Informative prior Weekly Updates can be found here.

The biggest challenges in the past week have been:

- Setting up PPP Spending Reports for our clients in QuickBooks to monitor usage of PPP to maximize forgiveness. Our clients have received more than $3 million in SBA funding so far.

- Watching PPP forgiveness and reporting requirements change weekly. Stay tuned as it looks like more flexibility in reporting for SBA programs is on its way though Congress.

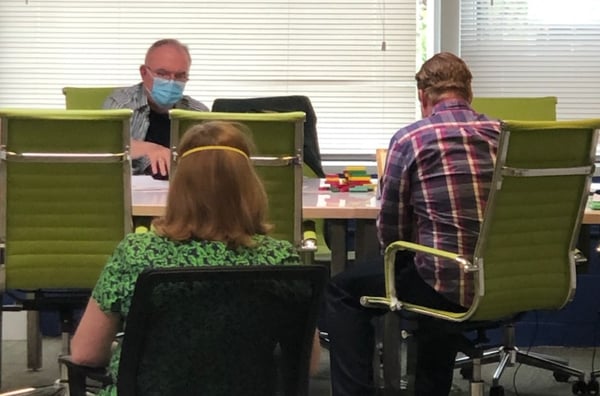

- Figuring out how to work efficiently while maintaining safe distancing, since we are in the office on a limited basis. Our Employee Policies for Office Work are helpful.

- Welcoming our first client to the office after providing him with Instructions for our Clients/Visitors to Enter the BudgetEase Office.

- Getting used to wearing masks. Thanks to all of you who reached out to us with great options. We are grateful to have so many who are concerned about us.

- Interpreting SBA PPP forgiveness guidelines. We are monitoring the time we are spending (wasting) on the PPP forgiveness application. The application is pretty straight forward and offers many opportunities to verify complete forgiveness. If your accountant or bookkeeper hasn't reached out to you, call them and use them to sort through the various options.

What you can do this week:

- Connect again with your clients on the phone or via zoom.

- Calculate the PPP forgiveness easily by creating a PPP Spending Report that includes payroll expense, SUTA, 401(k) matching, safe harbor, pension, rent, interest on mortgage, etc. filtered by the 8-week range from when you received funds.

- If you need to pay yourself, do so. The maximum is $15,385 for the 8-week period.

- Take an inspirational class of your dreams.

What we know about the PPP forgiveness:

- After you apply for loan forgiveness, your lender has 60 days to respond. The portion of funds that are not forgiven will accrue interest at 1% over the 2-year period from when you received the loan.

What our nonprofit clients are doing:

- If PPP proceeds are used to pay for expenses that already had a funding source, code the transactions separately (consider using customer or locations in QBO). Depending on the lender and the grantor, this issue may become important. Read your loan and grant documents carefully.

What the BudgetEase team is doing:

- Provided breakfast to the Emergency Room at the VA Hospital with the help of our client Six Shooter Coffee.

-

Surveying nonprofit organizations for what bookkeeping services they need at this challenging time, then developing services that will target the areas of greatest need. When nonprofits have information to analyze and report their financial information, they are able to weather this storm and be more impactful in the future. By helping nonprofits, BudgetEase is helping Bring the Economy Back.

-

Enjoying all the beards we are seeing on our banking and accounting friends. Seeing our most conservative friends relax their corporate image for a bit brings a huge smile to our faces.

-

Still practicing safe distancing, eating out on patios at restaurants, and having conversations in back yards with friends we haven't been with in ages.

- Offering Office Hours for free help in a group setting and one-hour free consulting to field questions from small organizations on scenario planning, cash forecasting, or any other bookkeeping question you may have. If you or a friend are confused, don't know where to start or just need some guidance, sign up. We look forward to helping you through your current bookkeeping frustration.

We hope you're staying healthy! If we can be of service, please contact us.