Sharpen Your Bookkeeping Skills!

Supercharge your QuickBooks Online and bookkeeping knowledge with one of BudgetEase’s focused bookkeeping training classes. Limited to eight individuals to personalize your learning, these bookkeeping classes will sharpen your bookkeeping skills so you become:

- More efficient

- Produce more accurate records

Bookkeeping training programs are virtual. You will be sent a Microsoft Teams link to join the class after you enroll.

Looking for Customized Training?

If you're looking for personalized training that meets your needs or the needs of your team members being trained, check out our Personalized Training & Advising option.

Top 10 Practices to Keep Your QuickBooks Online File Squeaky Clean

Cindy Gill leads this QuickBooks training class on the top 10 practices you should follow to keep your QuickBooks Online file in order.

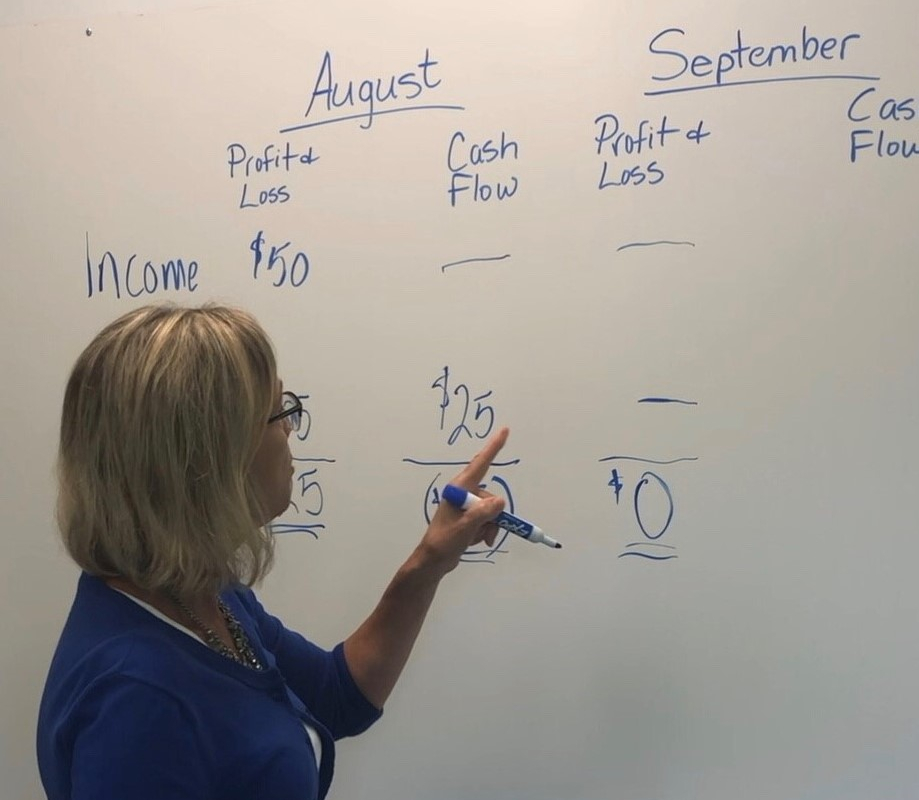

Business Financials and Best Practices for Non-Financial People

Cheryl Coyle helps you understand a simple chart of accounts, determine fixed vs. variable costs, and more in this bookkeeping training program.

How to use your Financial Statements to Make Sound Business Decisions

Cheryl Coyle helps you understand a simple chart of accounts, determine fixed vs. variable costs, and more in this bookkeeping training program.

Understanding Financial Reports for NonProfit Board Members

Listen to Cindy Gill break down the types of financial reports nonprofit board members should be looking at in the following bookkeeping training class.

Build a Budget Workshop

Start 2021 with a budget. Build a budget with step by step instructions based on prior financial information and expectations for the future.

Business Financials and Best Practices for Non-Financial People

Date: Friday, May 28th, 2021

Time: 9-11 a.m. EDT

Presenters: Kathy Dise and Cheryl Coyle

Audience: Non financial people, business owners

Cost: $120

After this bookkeeping class, you will: know the three parts of a balance sheet and three parts of profit and loss, as well as understand a simple chart of accounts, the difference between cash and accrual accounting, why cheating the IRS is not a good option, and more.

Top 10 Practices to Keep Your QuickBooks Online File Squeaky Clean

Date: Friday, June 11th, 2021

Time: 9-11 a.m. EDT

Presenter: Cindy Gill

Audience: QuickBooks Online users of any level

Cost: $120

Following this QuickBooks training session, you will be able to: correct data entry errors, find missing bills, reconcile all accounts and fix old uncleared transactions, record year-end audit adjustments, use prior period adjustments, and much more!

How to Use Your Financial Statements to Make Sound Business Decisions

Date: Friday, June 25th, 2021

Time: 9-11 a.m. EDT

Presenter: Cheryl Coyle

Audience: Small business owners and managers

Cost: $120

After attending this bookkeeping training program, you will be able to: identify what is important information for your small business, understand a simple chart of accounts, determine fixed vs. variable costs, record transactions properly to improve the quality of reports, create custom internal reports, and more.

Understanding Financial Reports for NonProfit Stakeholders

Date: Friday, July 9th, 2021

Time: 9-11 a.m. EDT

Presenter: Cindy Gill

Audience: Not-for-Profit employees and board members, non-financial people

Cost: $120

This interactive session will help you interpret and review an actual set of financial reports from a nonprofit organization. The discussion will include common grant restrictions, the importance of tracking grant balances, in-kind donations and the difference between donor-designated and board restricted funds. Special reports to monitor spending by grant and other financial information to expect will be covered. Other topics: Recording grant income the way the accountants want to see it versus the way other interested parties want to see it, establishing and maintaining a restricted cash account, and the difference between cash flow and net income.

Build a Budget Workshop

Date: TBD

Time: 9-11 a.m. EDT

Presenter: Kathy Dise

Audience: QuickBooks Online users of any level

Cost: $120

Build a budget with step by step instructions based on prior financial information and expectations for the future. In this session you will build your budget in QuickBooks online. As a result you will be able to compare actual financial information to your budget throughout the year. Must use QuickBooks Online with information already entered.