If your business pays sales commissions, you probably use a time-consuming excel spreadsheet to track them as they are paid out. Commission rates often vary by item and your salespeople may only be paid when the customer has paid you, which complicates things even more!

If your business pays sales commissions, you probably use a time-consuming excel spreadsheet to track them as they are paid out. Commission rates often vary by item and your salespeople may only be paid when the customer has paid you, which complicates things even more!

While QuickBooks lacks a dedicated resource for tracking and reporting commissions, the following method using items and a commission payable transaction detail report is an accurate, streamlined way to capture commissions.

The first thing you will need to do is set up two items (Products/Services) in QuickBooks. One will be named Commission Payable (a liability) and the other named Commission Expense (an expense). You must enter your sales commission percentage in decimals (.1 or .2 as opposed to 10% or 20%), while the expense will be negative.

You will then create a Group item using the Commission Payable and Commission Expense items you just created. You must assign your group a name, but don’t worry! It won’t print on your customer invoices, so you can name them anything you want to help you keep track of groups.

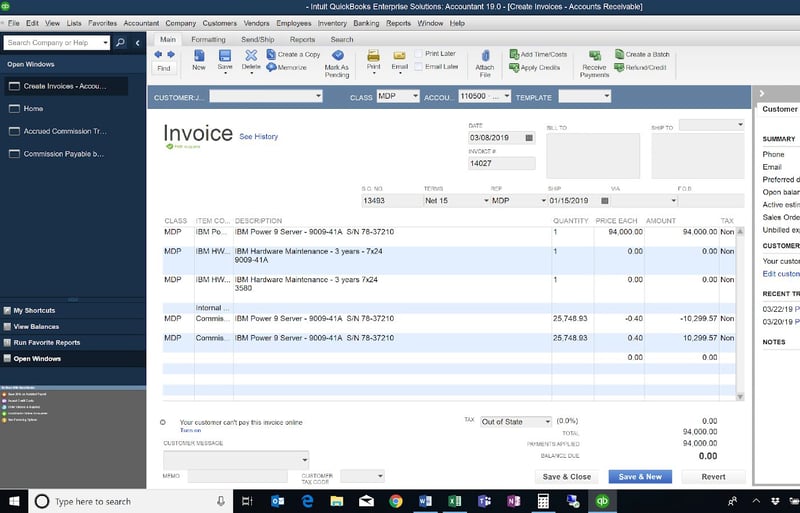

To begin recording and tracking commission on a Sales Order or Sales Invoice:

- Add the item Group to the sales order or sales invoice

- Copy/Paste the description

- Put the Sales Margin $$ in the Quantity field

- Change the commission to the correct % in the Price Each Field

The total Commission Expense and Payable will total $0 and have no effect on the invoice total.

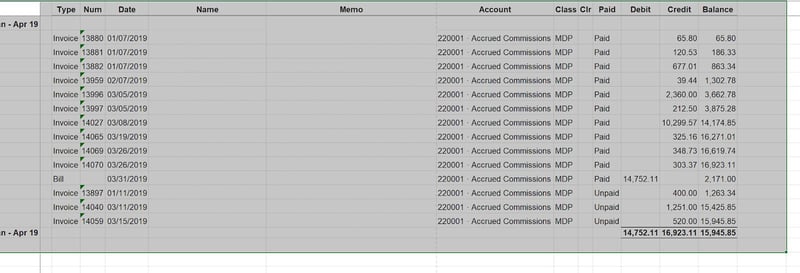

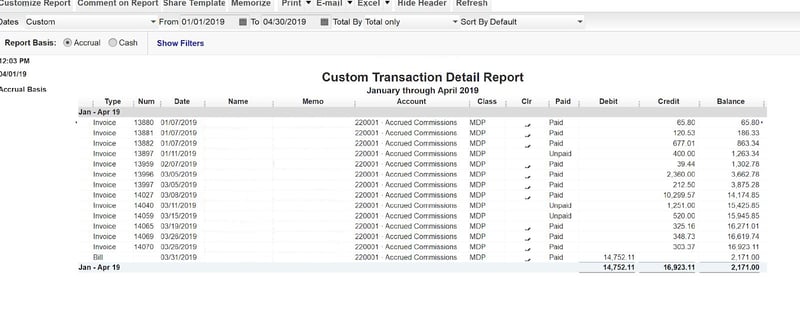

When you are ready to pay commissions, create a Sales by Item report filtering for the Commission Payable account only. You will want to add the Paid field, Rep, and the CLR (cleared) field. The Paid and Unpaid column will tell you whether or not the invoice has been paid by the customer. If the invoice is Paid, then it is time to pay the commission to the salesperson. Export the report to excel and sort by Paid/Unpaid.

Enter a bill or pay the commission in payroll. The debit to the Commission Payable account will reduce the payable balance.

After the bill or payroll is recorded, go to the Commission Payable Account Register and Check Mark Cleared to keep track of what has been paid to the salesperson and the Uncleared items are the balance still owed.

Still confused about accounting for sales commissions, give us a call at 216-333-1303.