At BudgetEase, we don’t just hope your books are accurate—we verify it. Our Quick Audit is a powerful tool we use to assess your bookkeeping health, whether you're a small business, nonprofit, or ...

Oct 15, 2025 12:41:00 PM

Read More

Bookkeeping Trends That Are Actually Worth Your Time Bookkeeping isn’t what it used to be—and that’s a good thing. In 2025, small businesses, nonprofits, and anyone tired of chasing receipts are ...

Oct 6, 2025 11:17:00 AM

Read More

The End of an Era For 30 years, your bookkeeper has been the quiet hero of your accounting service. She knew the banking, the passwords, the reports—probably even your lunch order. But now she’s ...

Oct 2, 2025 2:11:11 PM

Read More

Nestled in the heart of Cleveland’s Gordon Square Arts District, just steps from the breezy shores of Lake Erie, Stay Dog Daycare is more than just a pet care facility—it’s a haven for dogs and the ...

Sep 29, 2025 9:45:00 AM

Read More

At BudgetEase, we spend our days helping small businesses and nonprofits stay financially fabulous. But here’s the thing—small business owners also need to keep their personal finances in check, ...

Sep 26, 2025 10:14:00 AM

Read More

The Reporting Revolution In today’s world of small business and nonprofit finance, bookkeeping isn’t just about balancing the books—it’s about making sense of them. Whether you're tracking ...

Sep 23, 2025 11:41:00 AM

Read More-3.png)

QuickBooks Enterprise is making waves in the accounting service world, especially for small businesses juggling multiple entities. The standout feature? Intercompany transfers—finally, a way to move ...

Sep 18, 2025 1:00:40 PM

Read More

A Smarter Way to Pay Bills If you’ve ever stared down a pile of bills wondering if you’ve already paid that one from three weeks ago—QuickBooks Online has your back. The new bill pay feature is like ...

Sep 15, 2025 10:14:00 AM

Read More

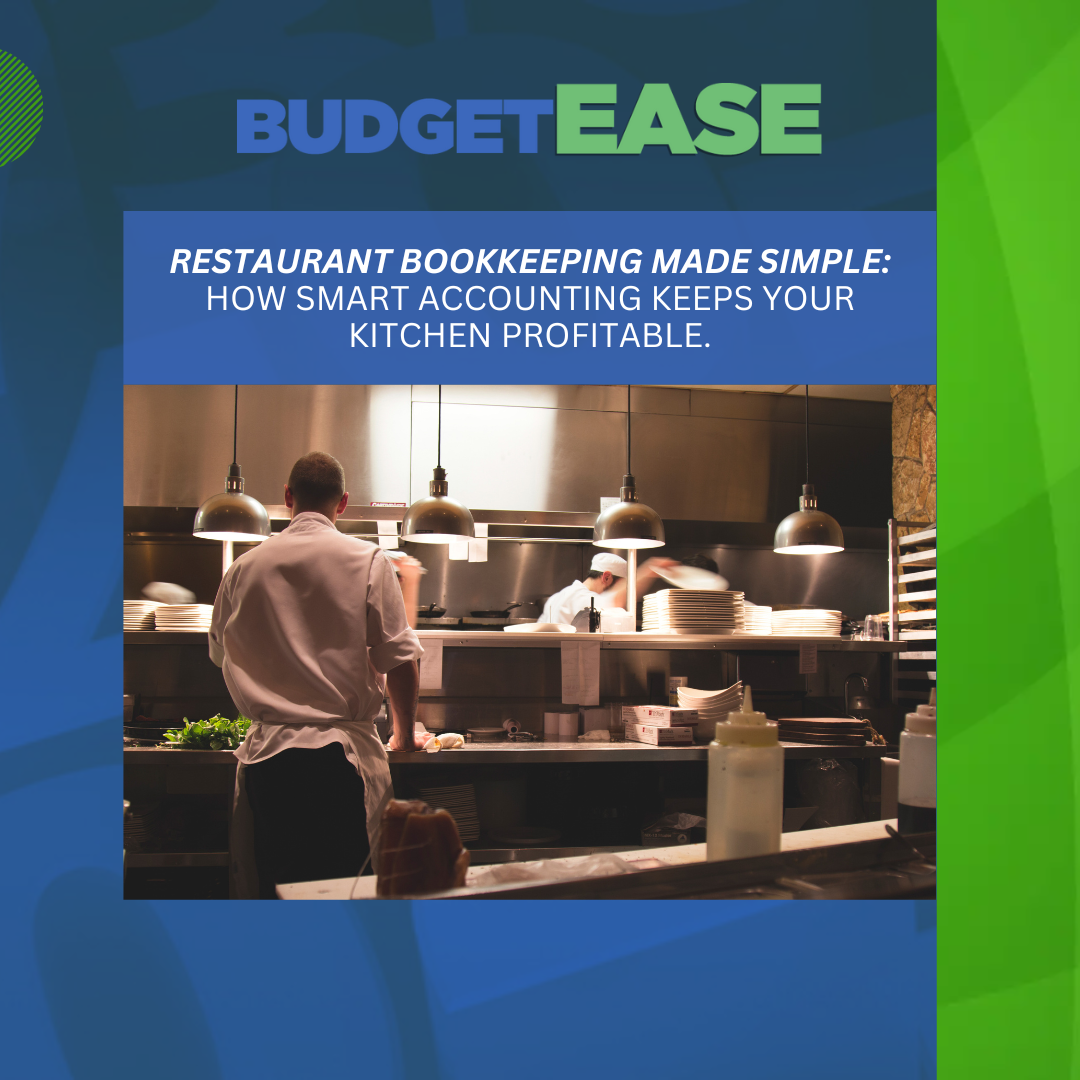

Why Smart Bookkeeping Is the Secret Ingredient to Success Running a restaurant is no small feat—between sizzling sauté pans and surprise health inspections, your books shouldn’t be the thing giving ...

Sep 9, 2025 1:27:35 PM

Read More.png)

At BudgetEase, our monthly client meetings aren’t about hunting down rogue receipts or decoding cryptic transactions. We handle the nitty gritty beforehand so you can focus on what really matters: ...

Sep 3, 2025 9:32:00 AM

Read MoreSubscribe to Email Updates

Recent Posts

- What’s a Quick Audit? How Small Businesses Can Verify Their Bookkeeping Accuracy.

- Bookkeeping Trends 2025: Smarter, Faster, and More Secure Financial Management.

- When Your Bookkeeper Retires: How to Protect Your Small Business and Find the Right Replacement.

- Client Spotlight Interview: Stay Dog Daycare

- 5 Personal Finance Tools Our Bookkeepers Secretly Swear By.

Posts by Tag

- Bookkeeping (261)

- Small Business (221)

- Financial Management (157)

- QuickBooks (135)

- small business bookkeeping (124)

- Profitability (100)

- Cleveland Bookkeeping (88)

- Online Bookkeeping Services (88)

- QuickBooks Bookkeeping Company (88)

- Bookkeeping Companies (82)

- For Accountants (67)

- Accounting (48)

- Non-profit Bookkeeping (47)

- Non-Profit Accounting (42)

- payroll (40)

- Budgeting (38)

- Virtual Bookkeeper (35)

- Nonprofit (33)

- Virtual Bookkeeping Services (31)

- Bookkeeper (27)

- Quick Books Online (26)

- Business Finance (19)

- Efficienies (17)

- Client Spotlight (16)

- Quickbooks Bookkeepers (16)

- Bookkeeper Near Me (15)

- Professional Services (15)

- Start-ups (15)

- Bookkeeping Catch Up Services (13)

- Outsourced Bookkeeping (13)

- Video (13)

- eCommerce (13)

- BusinessGrowth (11)

- Growth Mindset (10)

- Biotech (8)

- Cash Flow (8)

- Quickbooks Set Up Services (8)

- loan (8)

- Best Bookkeeper Near Me (7)

- Balanced Income Statement (6)

- Efficiency (6)

- Financial Journey (6)

- Financial Mindset (6)

- Grow your Business (6)

- P&L Monthly (6)

- Banking (5)

- Quick Books Help (5)

- Reconciliations in QBO (5)

- Secure Bookkeeping (5)

- Bookkeeping solutions (4)

- Digital Marketing (4)

- Small Business Finance (4)

- accounts receivable (4)

- Bookkeeping Support (3)

- Business Sustainability (3)

- Cash Flow Statement (3)

- Entrepreneur (3)

- Fraud (3)

- Non-Profit Taxes (3)

- Profit (3)

- Protect from Fraud (3)

- Quick Books Catch Up (3)

- Scam Alert (3)

- Scams (3)

- Small Business Taxes (3)

- Tax Filing (3)

- Tax Season (3)

- A Bookkeepers Guide (2)

- Accounting Made Easy (2)

- Accounting Tips (2)

- Accounting Transparency (2)

- Audit (2)

- BudgetEase (2)

- Business Start-Up (2)

- Case Study (2)

- Cost Effective Solutions (2)

- Employee Retention (2)

- Good Finance (2)

- How to Hire (2)

- In Kind Contributions (2)

- Incremental Improvement (2)

- Non Profit Finance (2)

- Non-Profit Donations (2)

- Non-Profit Hiring (2)

- Outsource Smart (2)

- QBO Training (2)

- QuickBooks Review (2)

- Record Keeping (2)

- Save Time Hiring (2)

- Small Business Financial Management (2)

- Small Business Hiring (2)

- Small Business Owner (2)

- Small Business Profit (2)

- Social Engineering (2)

- Year End (2)

- Year End Finance (2)

- 1099s (1)

- 10k small businesses (1)

- 2025 Goals (1)

- 2025 Small Business Goals (1)

- ACH Payment (1)

- AI for Accountants (1)

- AI for Bookkeepers (1)

- AI for Small Business (1)

- Academy Of Cleveland Ballet (1)

- Accounts Payable (1)

- Animal Rescue (1)

- BOI (1)

- Balance Sheet (1)

- Bench.com (1)

- Best Apps (1)

- Best Bookkeeper (1)

- Bill Pay (1)

- Bills (1)

- Bookkeeping Trends (1)

- Bounced Check (1)

- Budget (1)

- Business Competition (1)

- Business Mentorship (1)

- BusinessOperations (1)

- Butterfly effect (1)

- CFO, Accountant or QBO Expert (1)

- COVID Loan (1)

- CPA (1)

- Cancel Subscriptions (1)

- Cash Is King (1)

- CashFlow (1)

- Clean Books (1)

- Cleveland Ballet (1)

- Cleveland CPA (1)

- Cleveland Non-Profit (1)

- Closing your business (1)

- Community Development (1)

- Cost Savings Move (1)

- Credit Card Decline (1)

- DIY Bookkeeping (1)

- Digital Receipts (1)

- Disaster Loan (1)

- Dog Boarding (1)

- Dog Daycare (1)

- Donations (1)

- Dues and Subscriptions (1)

- EIDL (1)

- Easy Budgeting (1)

- Economic Impact (1)

- Eliminating Costs (1)

- Family Business (1)

- FinCEn (1)

- Financial Confidence (1)

- Financial Reports (1)

- Financial Success (1)

- Financial Visibility (1)

- Financial management for nonprofits (1)

- Financing (1)

- Find a Bookkeeper (1)

- Finding The Right Bookkeeper (1)

- Fiscal Agency (1)

- Fiscal Agents (1)

- Fiscal agent liability account (1)

- Global Education (1)

- Government Grant (1)

- Grass Roots Accounting (1)

- Growing Business (1)

- Healthcare Innovation (1)

- Healthcare Solutions (1)

- Hire A Bookkeeper (1)

- Hoarding Method (1)

- How To Find A Bookkeeper (1)

- How to close my business (1)

- How to prepare your financial reports (1)

- In Kind Donations (1)

- Interest Rates (1)

- Intuit Assistant (1)

- K1 (1)

- Keep Receipts (1)

- Keeping Up With Your Bookkeeping (1)

- Lawyer Trust Accounts (1)

- Ledger (1)

- Loans (1)

- Mobility (1)

- Monthly Meetings (1)

- Moving Your Business (1)

- NIH Grant (1)

- NSF (1)

- Non-Profit Volunteer (1)

- PayPal (1)

- Payment fees (1)

- Personal Budgeting (1)

- Personal Finance (1)

- Personal Tax for Small Business (1)

- Pet Adoption (1)

- Pet Parents (1)

- Point of Sale System (POS) (1)

- Pricing (1)

- Profit First (1)

- Profit and Loss (1)

- Prosthetics (1)

- QBO AI (1)

- Quarterly Review (1)

- Quick Audit (1)

- QuickBooks Enterprise (1)

- QuickBooks Loans (1)

- QuickBooks Reports (1)

- Quickbooks Bill Pay (1)

- Quicken (1)

- Receipts (1)

- Reconcile (1)

- Reporting (1)

- Restaurant Bookkeeping (1)

- Restaurant Finance (1)

- Retiring Bookkeeper (1)

- Return Item (1)

- Revenue (1)

- Saving Money (1)

- Small Business Closing (1)

- Small Business Debt (1)

- Small Business Invoicing (1)

- Small Business Quicken (1)

- Small Business Savings (1)

- Small Business efficiencies (1)

- Small Businesses Planning (1)

- Software Engineering (1)

- Space Needs (1)

- Specialized (1)

- Specialized Bookkeeping (1)

- Square (1)

- Streamlining Processes (1)

- Success Tips (1)

- The Power of One (1)

- Timeless Bookkeeping (1)

- Toast (1)

- Volunteer Budget (1)

- Volunteer Management (1)

- Volunteers (1)

- What's New (1)

- Women In Leadership (1)

- Work Smarter (1)

- World Class Ballet (1)