A law firm is responsible not only for representing clients fairly but also for managing client advances and deposits for court fees, fines, and other potential payments. Any Interest on Lawyers Trust Account (IOLTA) is used to hold funds that do not currently belong to the lawyer or are under dispute. Without taxing the public and at no cost to lawyers or clients, the interest earned from IOLTA accounts is pooled to provide civil legal aid for the poor and support justice system improvements. Given the timing and sensitivity of legal matters, client funds are held in escrow by attorneys in these special accounts.

A law firm is responsible not only for representing clients fairly but also for managing client advances and deposits for court fees, fines, and other potential payments. Any Interest on Lawyers Trust Account (IOLTA) is used to hold funds that do not currently belong to the lawyer or are under dispute. Without taxing the public and at no cost to lawyers or clients, the interest earned from IOLTA accounts is pooled to provide civil legal aid for the poor and support justice system improvements. Given the timing and sensitivity of legal matters, client funds are held in escrow by attorneys in these special accounts.

While these separated funds are maintained in the name of the law firm, the IOLTA is managed by the state and interest accumulated is due back to the client.

Why Should Lawyers Place Retainer Funds Into an IOLTA?

Not only does the bar association have rules for reporting IOLTAs, there are also mandates on keeping a detailed balance sheet for each individual client’s deposits and disbursements. If lawyers don’t properly track these items, the ethics board can cite a violation and even revoke an attorney’s law license.

Protect Your Livelihood and Your Law Firm!

Here is how to setup IOLTA accounts in QuickBooks:

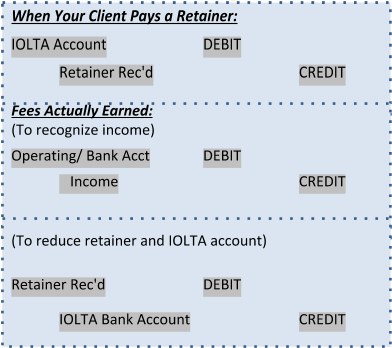

Go to Chart of Accounts > Create 2 items:

- RETAINER REC'D = Current LIability

- IOLTA/TRUST ACCOUNT = Bank Account

Having trouble keeping track of your clients’ retainers and detailed balance sheets? If you need any help with bookkeeping for IOLTAs, we recommend attorneys reach out to their accountant, a law practice management consulting firm or a knowledgeable, qualified bookkeeper like BudgetEase.