If you pay employees biweekly but recognize income monthly, your revenue won’t align with the expenses that helped generate it. This causes your income statement (P&L) to understate expenses in some months and overstate them in others.

If you pay employees biweekly but recognize income monthly, your revenue won’t align with the expenses that helped generate it. This causes your income statement (P&L) to understate expenses in some months and overstate them in others.

As a business owner, this mismatch makes it difficult to accurately assess your organization’s financial health, leading to frustration.

A journal entry at month end works to accrue a liability for the wages your employees earned but you have not yet paid. Here are the four steps to creating an accrual journal entry and solving this problem so that your P&L is more meaningful.

Step 1: Determine the Number of Days for Which Wages Were Earned but Not Paid

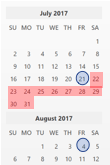

If your paycheck dates are July 21 and August 4 (blue circles), wages have been earned from July 22-31 but not yet paid to your employees. Without a journal entry, the money earned over these 10 days (red shaded days) is missing from the July P&L. For the month, this understates your Cost of Goods Sold and overstates your Net Income.

missing from the July P&L. For the month, this understates your Cost of Goods Sold and overstates your Net Income.

Step 2: Determine the Payroll Cost

For the days shaded in red, you must determine the gross payroll cost incurred. If your staff are salaried, calculating the cost is straightforward: salary divided by 365 multiplied by 10, the number of red shaded days.

For hourly staff, review the timesheets and calculate the hours worked during the red shaded days. Be mindful of staff earning different hourly rates.

Step 3: Prepare the Accrual Journal Entry

Prepare a journal entry dated the last day of the month with the amounts calculated in step two. The debit in this journal entry will go to a wages expense account. More than one debit for wages expense may be needed depending on the detail with which you break down your staff’s earnings (e.g. wages per department, training, vacation, etc.). The corresponding credit will go to a wages payable liability account.

You may wish to make a similar accrual journal entry for tax expense and tax payable. The calculation for this number is to multiply the gross payroll expense by the employer’s tax responsibility percent.

Step 4: Record Next Month’s Payroll

If you are just implementing this accrual process, you will be used to expensing the entirety of each payroll run to a wages expense account. Now, instead of doing that, you will debit the wages payable account used in step three to zero it out and debit the remaining balance to the wage expense account. If you have accrued taxes payable, do the same for that expense.

At BudgetEase, we love making financial data understandable and useful to small business owners. If you want help having a more accurate monthly picture of your labor costs and net income, or have any other questions about best practices when it comes to tracking the costs associated with the product or service you sell, BudgetEase is here to help!