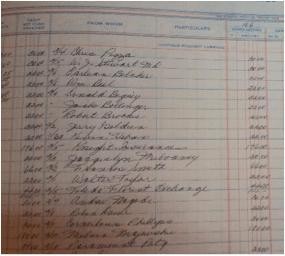

When cleaning out my childhood home, I came across the ledger books from my grandfather’s business, Superior Typesetting. The payroll ledgers date back to 1945 when a mere 16% was being withheld for taxes, nothing for health insurance. There were deductions for War Bonds. The hourly wage was less than $1 an hour.

When cleaning out my childhood home, I came across the ledger books from my grandfather’s business, Superior Typesetting. The payroll ledgers date back to 1945 when a mere 16% was being withheld for taxes, nothing for health insurance. There were deductions for War Bonds. The hourly wage was less than $1 an hour.

The books weigh over 20 pounds. Each line in the journal is impeccable and neatly written. I have memories of my great aunt Dolly working on these huge books when I visited the office.

Much has changed since then. Typesetting with metal type stopped in the 70's as innovations with electronic type started. Now you could prepare a pamphlet on your home computer and print it, too.

Big Journal and Ledger Books have disappeared as well. At BudgetEase we manage our clients’ financial information with our fingers on keyboards and eyes glued to a computer screen. Still, occasionally we come across someone who still uses ledger paper to keep track of their financial records – REALLY. And they are managing fine.

Why should they consider using QuickBooks to keep track of their financial data? Could they ever make the leap to QuickBooks Online – the system we recommend to most companies that we work with?

Why Consider the Switch to QuickBooks?

Using accounting software such as QuickBooks is an efficient use of your time. With easy to use templates, owners can create invoices, enter bills, and print checks with ease. Generating detailed and accurate reports with QuickBooks is a snap and provides the confident reporting lenders and tax advisors like to see. Owners too will gather useful financial data from the reports such as cash flow, trends, and sales by product line. QuickBooks integrates well with other financial programs such as excel and bill.com. In addition, bank transactions can be downloaded directly into QuickBooks, which allows for effortless transfer of data.

Are There Benefits of Manual Accounting?

If you are on a tight budget or have software concerns, consider staying the course of keeping your books by pen. Attention to detail, plenty of time and great penmanship are required. As a result, an in-depth working knowledge of your company’s books is maintained. If your company has loans or multiple bank or credit accounts manual accounting will be complex.

While QuickBooks allows flexibility, pen allows for the ultimate accounting flexibility. When you purchase an accounting software program, you in effect buy into a way of working within the limits of the software design.

When you outgrow your ledger paper and journals, call us. Don’t worry about the transition. Other clients have been very happy with the change. BudgetEase set up their new account and then provided the training they needed to keep their financial records up to date.