If you have a very small company with only a couple of business checking or credit card accounts and don’t want to pay for QuickBooks, how can you track your financial records?

If you have a very small company with only a couple of business checking or credit card accounts and don’t want to pay for QuickBooks, how can you track your financial records?

You can use an excel spreadsheet to record your sales and expenses.

Step One

Decide what categories are important to your business. Here is an example:

| *Revenue (Income) |

| Needs Category |

| Salaries (Expense) |

| Materials (Expense) |

| Marketing (Expense) |

| Computer and Internet (Expense) |

| Professional Fees (Expense) |

| Office Supplies (Expense) |

| Travel (Expense) |

| Meals and Entertainment (Expense) |

| Training (Expense) |

| Insurance (Expense) |

| Utilities (Expense) |

| Dues and Subscriptions (Expense) |

| Rent (Expense) |

| Bank charges (Expense) |

| Telephone (Expense) |

Step Two

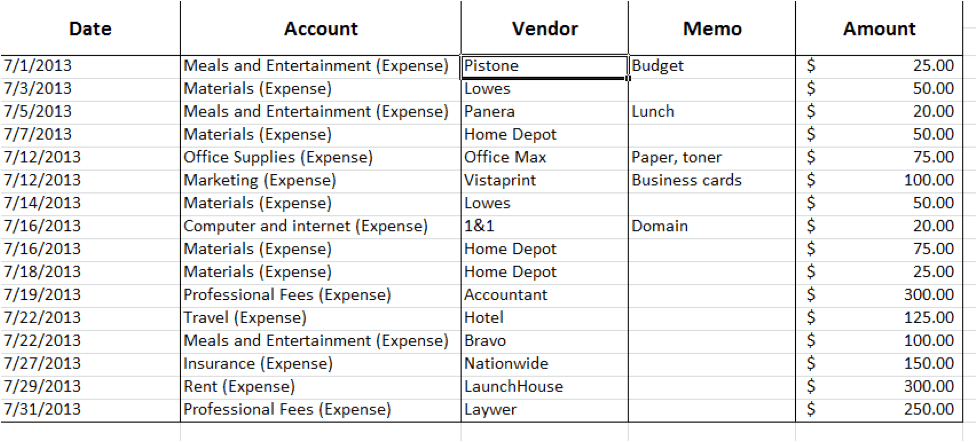

Start entering all the transactions from your bank and credit card statements into an Excel Sheet. An alternative suggestion is that you could get an electronic listing of your transactions from your bank in a CSV or Excel format. Then all you need to do is categorize each transaction. The categories are in the Account column in the following example:

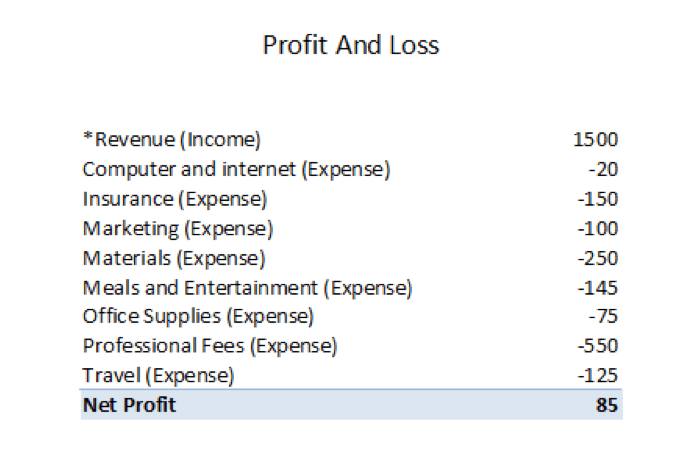

You don’t want to give up the ability to see what your profit is so we have put together a helpful spreadsheet that will convert your bank information into a Profit & Loss Statement. With our spreadsheet, your transactions above are converted automatically into the P&L below.

To get started, click below to get a preformatted spreadsheet that will allow you to prepare a Profit and Loss like we did.