Small businesses need cash to grow. Your Accounts Receivables are your cheapest source of cash. Set up an efficient AR collection procedure to maximize the cash you will have on hand.

Our proven Accounts Receivable Collections Schedule is:

10 days past due, send a statement via email

20 days past due, call

30 days past due, call again

45 days past due, visit client

A good Schedule will train your clients to get in the habit of paying you on time. You are not their bank. We’ve found this Schedule to be especially valuable to service companies where their value is less tangible. We regularly see a direct correlation between the older the invoice, the less memory of the excellent job that was done. Don’t let this happen to you.

Here are the 5 most effective things you can do to increase your cash:

-

Make the Term on Invoices 10 days

-

Follow Your Collection Schedule

-

Keep your Contact Information Current

-

Have Good Boilerplate Wording in Your Cover Letter

-

Set up an Automatic ACH for Chronic Slow Pay Customers

Here’s how to easily implement the 5 most effective steps:

1. Make the Term on Invoices 10 days

Studies show that receivables are paid quicker with a 10 day term than when they are payable on demand. Here's how:

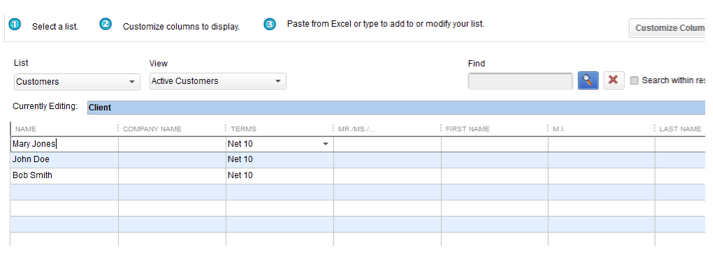

Desktop

- Under the lists menu should be add/edit multiple items – make sure List is set to Customers

- When that screen is up, select customize column

- Add the terms field to the display

- Set the top block in that column to net 10, right click and select copy down the rest of the client

- Save

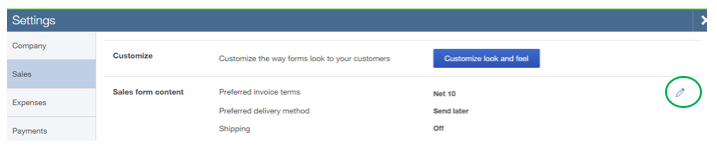

Online

- Go to the Gear

- Company Settings

- Sales

- Click the edit on the right

- Change Preferred Invoice terms to – Net 10

2. Follow Your Collection Schedule

10 days past due, send a statement via e-mail

20 days past due, call

30 days past due, call again

45 days past due, visit client

- Make a copy of this Schedule.

- Enlarge it. Post it. Make it a habit.

- Delegate some of the responsibility so there are two people following up.

- Make the phone call. It is an opportunity to stay in touch with your clients. You may find the non-payment is a simple internal administrative issue. You may find they had a question on your work that you can easily fix.

You will be glad you followed these suggestions. In 3 months you will see a dramatic increase in your bank balances.

How to Send a Statement (This takes less than 5 minutes)

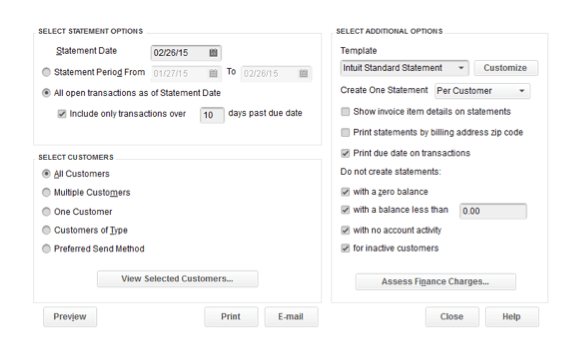

Desktop

- Make sure you have processed all payments

- Under Customers

- Create Statement

- Choose the Statement Date

- Choose Open Transactions as of Statement Date

- Include only transactions over 10 days old

- Select All Customers

- View Selected Customers to make sure you agree with the list

- You can customize the template if you like (but this takes time – better to get the statement out on time)

- Print the due date on the transactions

- Don’t create zero balance or less

- Assess a Finance Charge if you can

- Print or Email

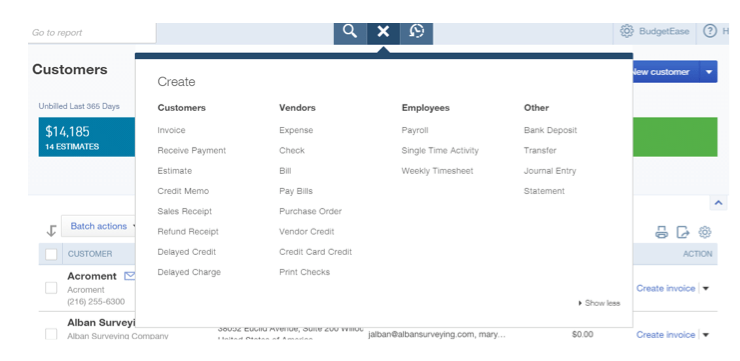

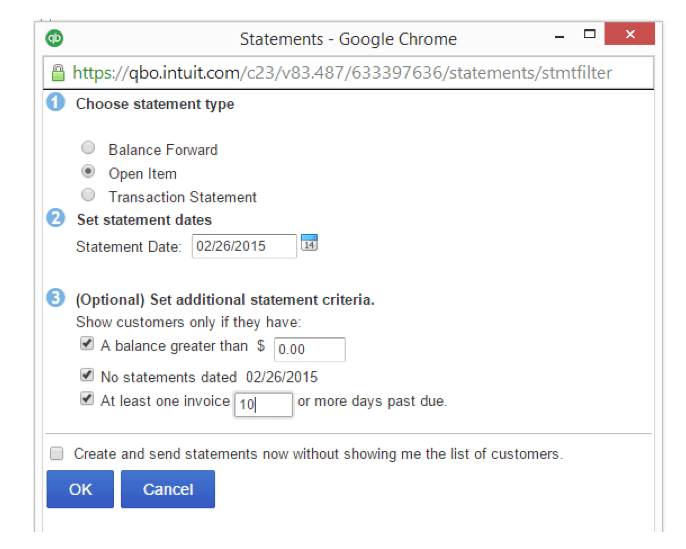

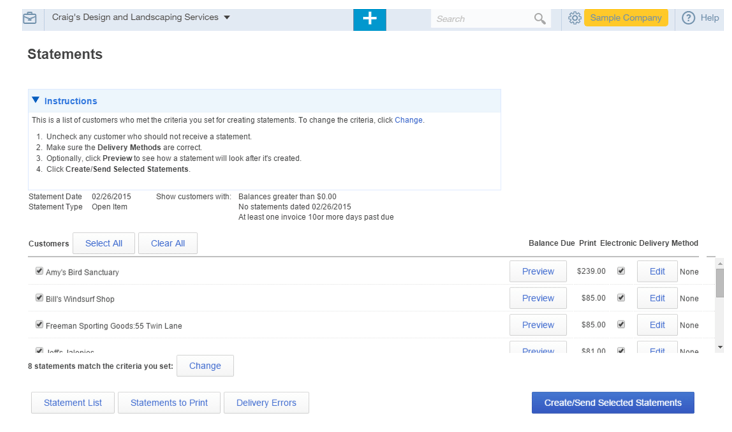

Online

- Make sure you have processed all payments

- Quick Add Button on top Center

- Under Other – Choose Statement

- Choose Open Item

- Choose today’s date

- Choose balances greater than $0, No other statements that day, At least one invoice 10 or more days past due

- Click OK

- Here you can double check the Clients to receive a Statement

- The check mark is for print- if you want to email, uncheck and make sure email address that pops up is correct

- Check the box that asks if you want to use the email address for future statements

- Click Statement list if you want to see who received a statement recently (so you don’t accidentally send a client too many statements)

- Click Create/Send Selected Statement

That’s it. Easy – right!?

3. Keep your Contact Information Current

Often your contact with your client leaves or there is a change of responsibility. How do you know if something changed – YOU DON’T! Nobody thinks to let you know. What do you do? Assume if you don’t hear anything that your client didn’t get your call/email. As soon as possible, do some digging to make sure someone has your request.

The quicker you are aware of a change, the quicker you are paid. Keeping contact information up to date in QuickBooks is crucial.

4. Have Good Boilerplate Wording in Your Cover Letter

QuickBooks has some great wording for your statement cover letters. Here's how to find it:

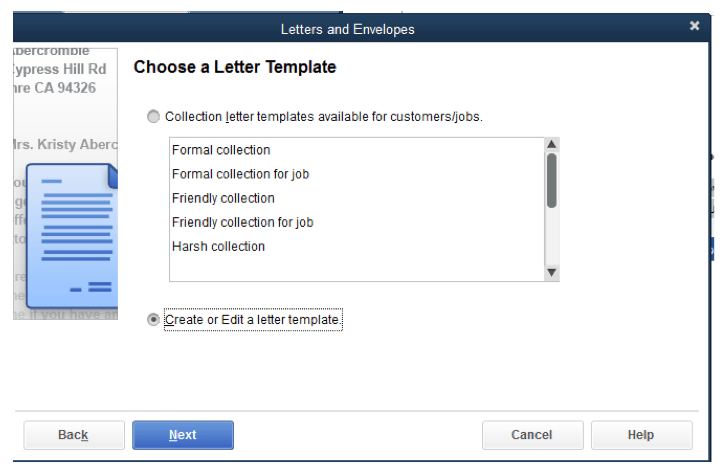

Desktop

- Go to Company

- Prepare Letters and Envelopes

- Collection Letters – there are 5 to choose from – pick the one that best suits your situation

The Friendly Letter Wording QuickBooks provides is our favorite:

Just a friendly reminder that you have 2 overdue invoice(s), with an overdue balance of $1,500.00. If you have any questions about the amount you owe, please give us a call and we’ll be happy to discuss it. If you’ve already sent your payment, please disregard this reminder.

We appreciate your continuing business, and we look forward to hearing from you shortly.

Sincerely,

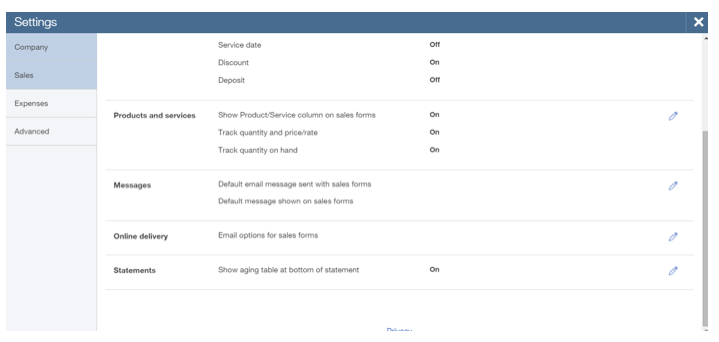

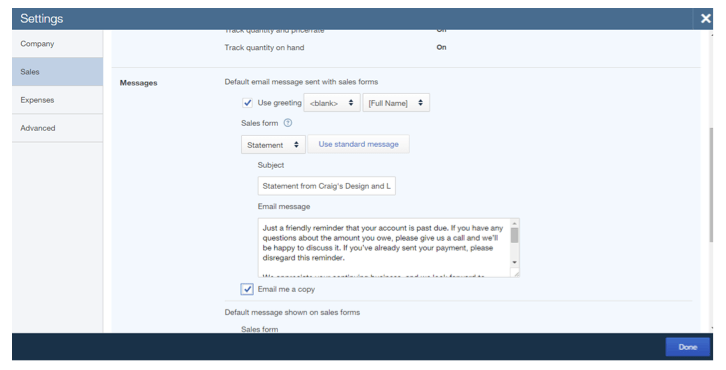

Online

- Go to the Gear

- Settings

- Sales

- Messages – Edit

- Later come back and review Online delivery and Statements

- Paste in a message that works for you

- Check Email me a copy

- Click Save then Done

5. Set up an Automatic ACH for Chronic Slow Pay Customers

Some customers need more assistance. You can set up with QuickBooks Payments the ability to charge your customer’s bank account or credit card. There is a charge for this service. If you don’t have many transactions, you can choose a higher transactions fee and a lower monthly fee. Here is how to sign up:

Desktop

- Go to Help

- Add QuickBooks Services

- Get paid faster

- Apply for QuickBooks Payment

Online

- Go to Gear

- Company Settings

- Payments

- Apply for QuickBooks Payments or link an existing account

Have your client fill out a form to keep on file. Forms are available on QuickBooks Payments. We also have a copy of the form you can use here.

These are our 5 steps for controlling your Accounts Receivables. Let us know if you have questions or need help for your specific challenges. We’d also love to hear about your successes.