I hear regularly "I want to improve my profitability."

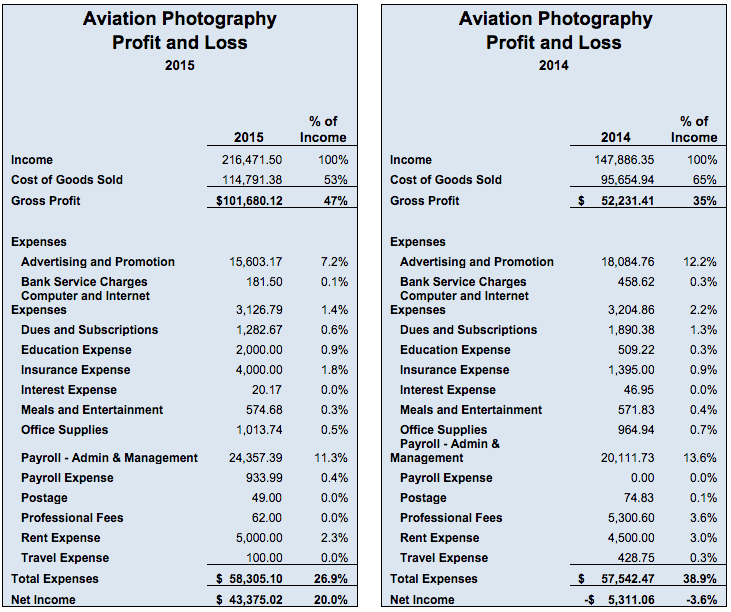

Here is the P&L from a company that improved their return on sales to 20% from -3.6% the prior year:

How did this company improve their profitability by 23%?

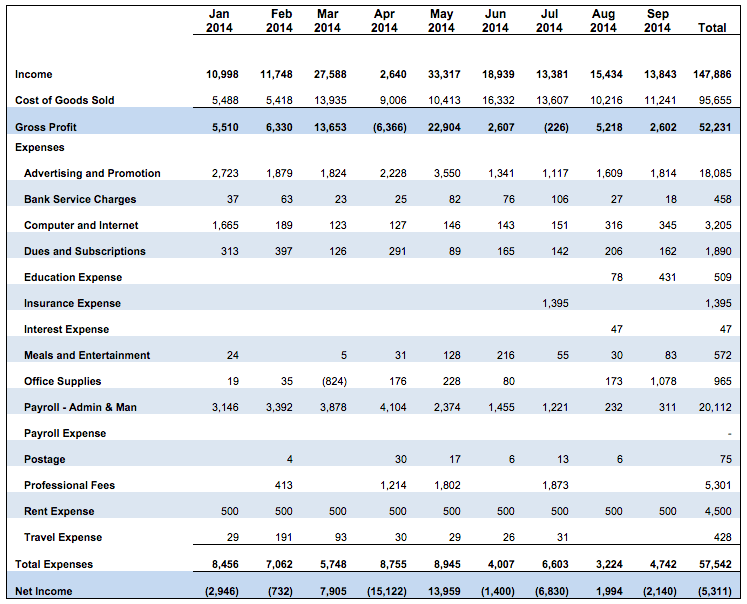

- Look at the past year and recent months.

- Determine what incremental change you could make next month.

- This example shows $18,000 best month. Can that month be duplicated? Build from the best month. If you maintained your best month, sales for the next year would be $228,000. That is a 55% increase in sales year over year.

- Expenses – can you find hidden fees? Look at the largest expenses first. In our example, Cost of Goods Sold. This company was able to reduce the cost of the materials going into their product. The result was a 20% decrease in cost of sales.

- 45% increase in sales – is only a small increase each month – around 2% or $300 each month.

- How many additional items or customers do you need to increase sales by $300?

Many companies don’t have good information to produce a forecast. Where could they start?

- Separate business and personal accounts

- Set up meaningful categories. Have an informational chart of accounts.

- Find a financial system you are addicted to. The best financial system is worthless if you don’t keep it current.

How often should I update my financial information?

- Add transactions weekly – have a rhythm.

- Review the information for mistakes monthly.

- Compare the current month to your forecast monthly to see if you are on track.

- Adjust immediately by reducing costs or focusing on areas that need improvement.

- Reconcile all your bank accounts monthly.