Wondering how to properly keep track of your Interest on Lawyer Trust Accounts (IOLTA). To many small businesses, keeping records is downright confusing. We recommend keeping track of individual client funds. The best way to accomplish that is to set up your Chart of Accounts using subaccounts for each client.

Wondering how to properly keep track of your Interest on Lawyer Trust Accounts (IOLTA). To many small businesses, keeping records is downright confusing. We recommend keeping track of individual client funds. The best way to accomplish that is to set up your Chart of Accounts using subaccounts for each client.

The Process

Here is the process for setting up your Chart of Accounts, creating a new client, receiving funds into IOLTA, creating invoices, and ultimately removing the IOLTA funds as they are earned:

- Create an account (Other Current Liabilities) in the Chart of Accounts called “Funds Held in Trust.” This account will be the parent account for the Trust client sub-accounts.

- Create a new Customer/Client – “New Client” in our example

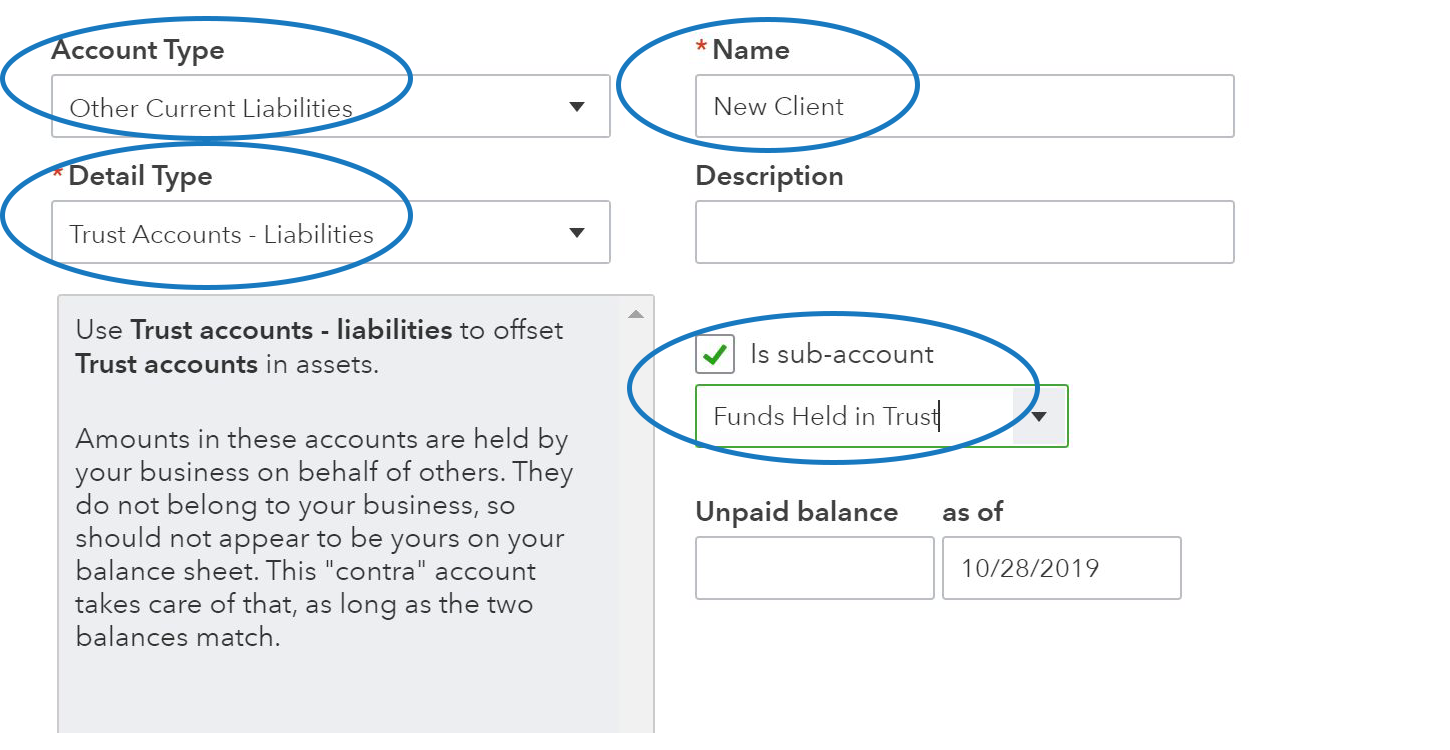

- Create a sub-account in Trust for your new client. To do this:

- Go to Chart of Accounts

- Select “New”

- Type = “Other Current Liabilities”

- Detail = “Trust Account Liabilities”

- Name = Use customer name you just created

- Check “Sub-Account” and choose “Funds Held in Retainer”

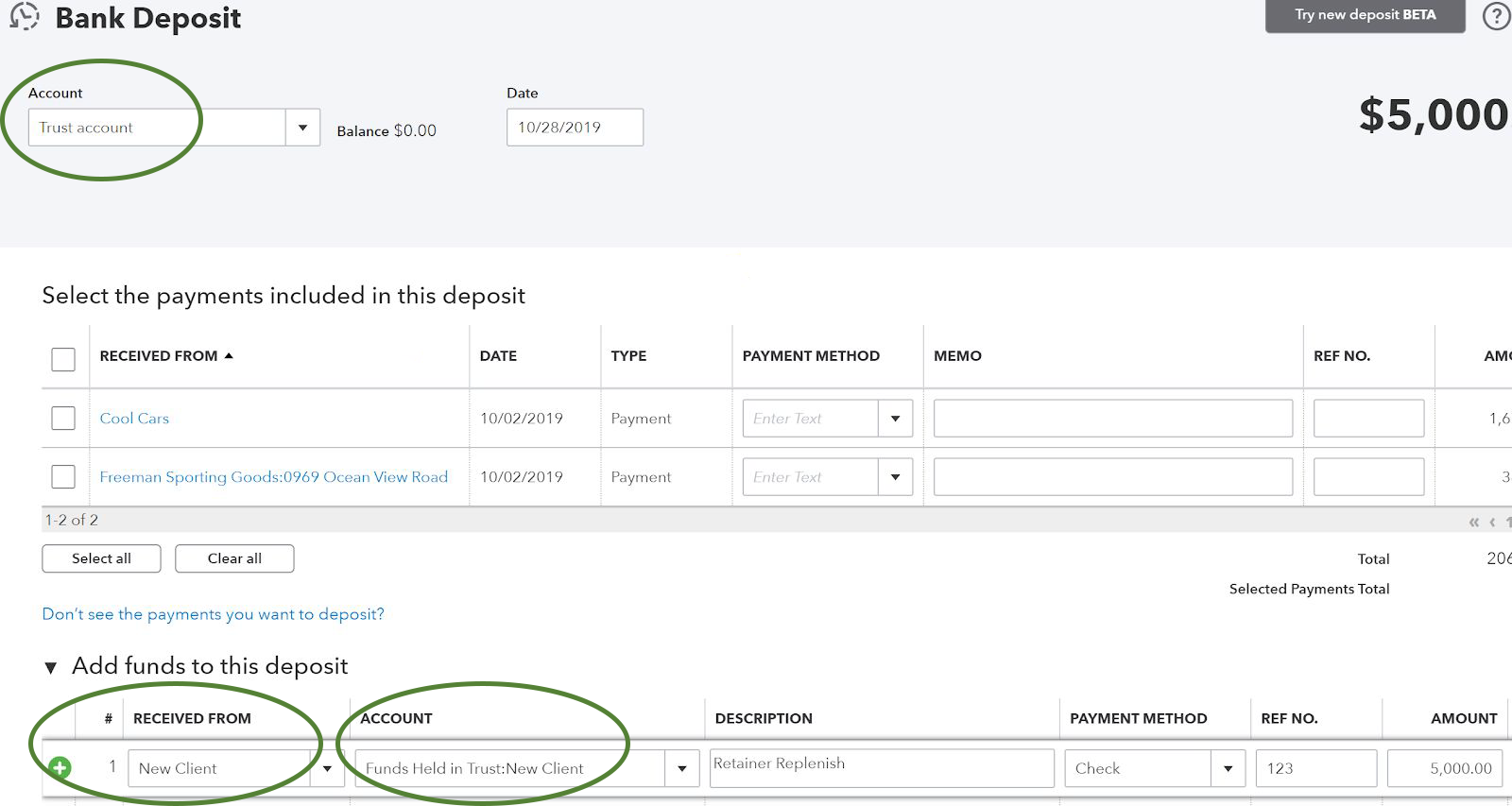

- Deposit the retainer. Here’s how:

- “Make a deposit”

- Choose IOLTA

- Received from = new customer you created

- Account = sub-account for New Client in Trust

- Create an invoice for the work performed

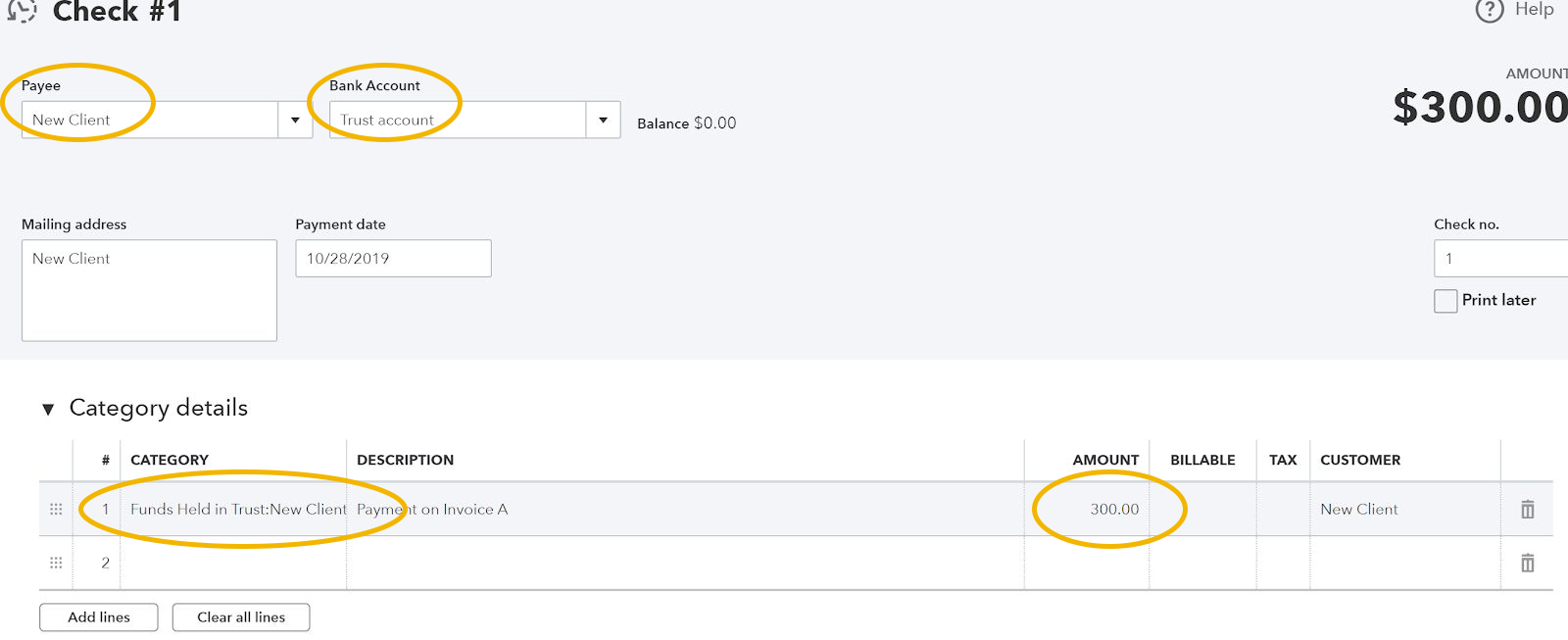

- To receive payment on invoice for worked performed from the client’s retainer, you need to write a check.

- Payee = client

- Bank = Trust

- Category = Client sub-account under “Funds Held in Trust”

- Description = whatever you choose

- Customer = client name

- Receive payment on invoice

- Customer = new client

- Payment = invoice amount

- Remember to manually move funds from the Trust to your checking (outside of QuickBooks)

Need More Help?

Trust accounting can be confusing. Contact us at www.budgetease.biz so we can help you get the process started.