While you don’t want to mismanage any of your accounting records, mismanaging a trust account (IOLTA – Interest on Lawyers Trust Account) can have terrible consequences. Keep in mind, trust funds are not your money, at least not yet.

While you don’t want to mismanage any of your accounting records, mismanaging a trust account (IOLTA – Interest on Lawyers Trust Account) can have terrible consequences. Keep in mind, trust funds are not your money, at least not yet.

Common Trust Accounting Mistakes

Not Maintaining Separate Accounts

Keep trust funds in a separate bank account. At no time should operating funds and trust funds commingle. Tracking funds become very difficult if you are using one account for general business and trust transactions. Additionally, mingling funds can lead to the appearance of impropriety.

Some small businesses go so far as to keep trust funds in a different bank from their general business account.

Reconcile

Small business owners often do not reconcile trust funds regularly and balance the trust liability in their balance sheet to the bank statement.

Keep trust funds in a separate bank accountManual Ledgers

It’s best to use an accounting system, such as QuickBooks, to maintain records instead of a paper-based ledger system. In QuickBooks, it’s easy to provide an audit trail should you need to.

Overdrawing the Account

Make sure to only write checks that you have funds to cover. Overdrawing a trust account is immediately reported to the State and has unpleasant consequences.

Trust Account Best Practices

Documentation

Make sure you have clear documentation and are transparent with your client on how and when you will move funds from their trust account to your business account.

Maintain Client Sub-Accounts

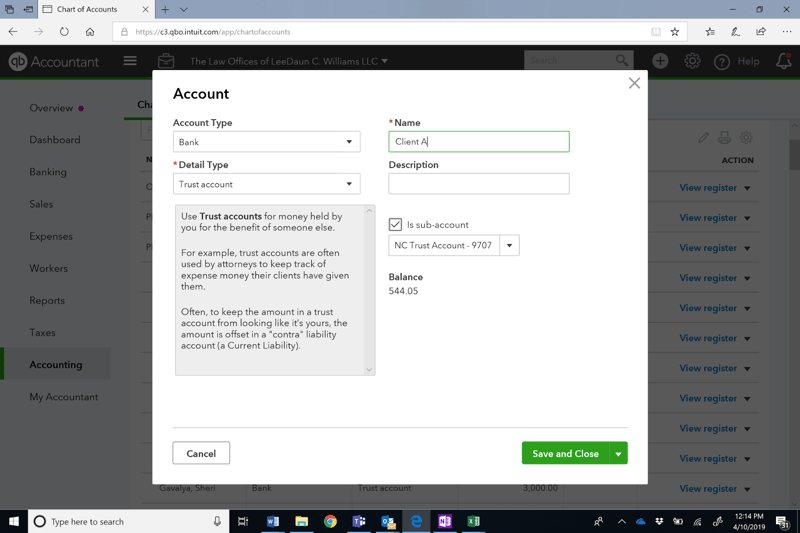

Each client should have their own sub-account showing all activity. Each sub-account should be reconciled monthly to ensure there were no mispostings between clients. Creating sub-accounts is very easy to do in QuickBooks.

Create a sub-account in QuickBooks Online by adding a new account in the Chart of Accounts. Below are the parameters you would use:

Contact us if you need help setting up sub-accounts or creating procedures to manage your trust clients.

Contact us if you need help setting up sub-accounts or creating procedures to manage your trust clients.