Accepting stock donations isn’t just for the big players—small businesses and nonprofits can do it too! But when it comes to recording these gifts, accuracy matters. Let’s tackle the most common question we hear:

How Should a Nonprofit Record and Acknowledge a Stock Donation?

First things first: calculate the value of the donation using the average of the high and low prices on the date of the gift (for publicly traded stock). This ensures transparency and compliance.

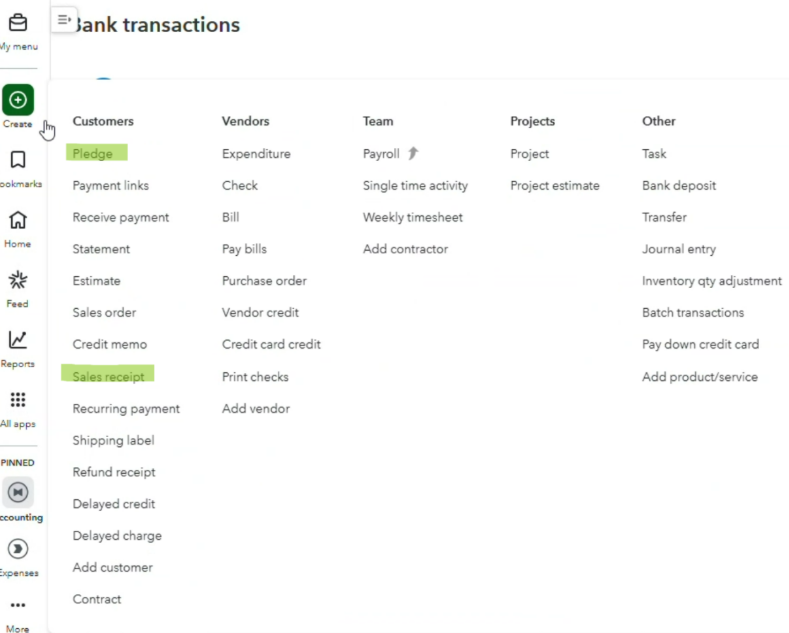

Next, head to QuickBooks Online (QBO) and make these entries:

- At Donation:

- Receive the Deposit a Pledge or a Sales Receipt.

- Note: If you are using classes for a non-profit, this may be “Fundraising,” for example.

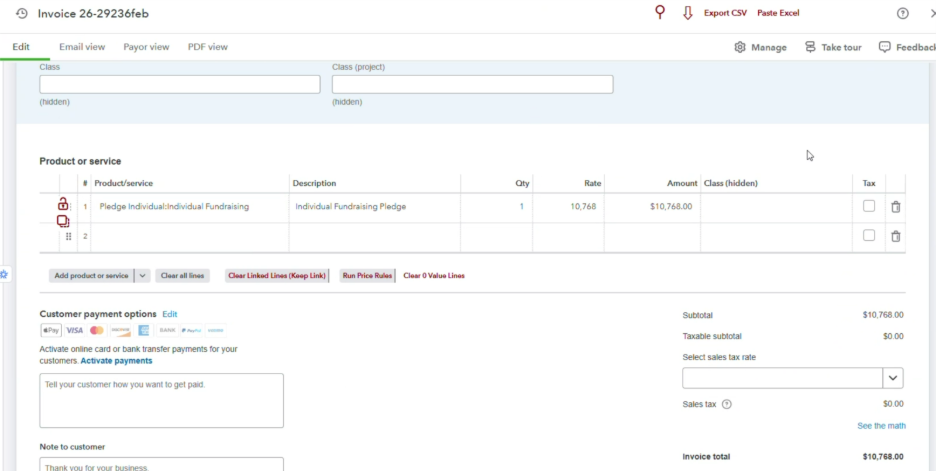

Here is what your Pledge would look like if it was from an individual. You should already have Items (Products and Services) set-up for use in a Sales Receipt or Pledge. If you are confused by this, you definitely need to call us.

- Receive Payment, as you would any pledge with payment type be “Stock” and it would be deposited, into your Brokerage account such as Schwab.

- After you sell the stock enter the value of the sale in dollars and to make it balance to the Brokerage account balance you may have a Gain or Loss on the sale which is an Other Income/Expense account in QBO.

- Then you would immediately transfer the funds from your Brokerage account (Schwab) to your bank account or Investment Fund by:

-

- Debit: Bank Account

-

- Credit: Brokerage Account

-

- Record any Gain or Loss in an Other Income Account. Fees and commissions? Use an Other Expense account or Bank Charges.

Finally, send an acknowledgment letter to the donor stating the donation amount based on the same valuation method. It’s not just good bookkeeping, it’s good manners.

Why Does This Matter?

Proper handling of stock donations keeps your books clean, your donors happy and shows what a professional organization you run. Whether you’re a nonprofit or a small business outsourcing your bookkeeping service, accuracy builds trust.

Ready to Simplify Your Accounting?

If this sounds overwhelming, you’re not alone. Many organizations turn to outsourced accounting or QuickBooks catch-up services to stay on track. That’s where we come in.

Contact BudgetEase today—because your books reflect on you and your organization and builds trust with your constituents.