It's time to close the books on 2020, but before you close the year in QuickBooks, you need to ensure a few things are done.

It's time to close the books on 2020, but before you close the year in QuickBooks, you need to ensure a few things are done.

Make sure you:

- Reconcile and Review Bank and Credit Card Statements – once you complete the reconciliations, ensure the ending balances agree with those found on the balance sheet and general ledger. You may have to consider uncleared transactions.

- Billings – make sure you have billed for all of your 2020 work.

- Check Accounts Receivables – do you have uncollectible accounts to write-off as bad debt?

- Ensure Accuracy of Accounts Payable – are there duplicates or uncategorized expenses?

- Inventory – if you have it, make sure you have a count as of December 31st.

- Payroll Liabilities - if you use a clearing account, ensure it has a zero balance. Check to ensure that your payroll tax deposits match the quarterly return.

- Check your balance sheet and profit & loss - does everything make sense? Are there gaps in expenses? Do you have uncategorized income?

- Record Depreciation

Don’t forget to close the year in QuickBooks. Once you have made all the necessary changes, you don’t want to make a mistake and change anything in a prior year. Closing your books will ensure you don’t make that mistake.

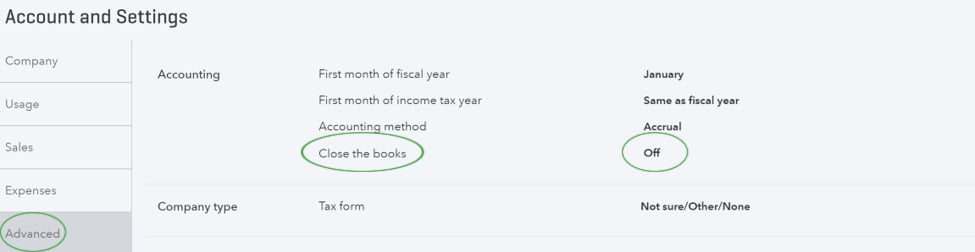

Procedure to close the books in QuickBooks Online:

Go to Settings, select “Advanced” and turn on “Close the books.”

Visit us at www.budgetease.biz to see how we can help ensure the accuracy of your bookkeeping prior to preparing your taxes.