The Accountant Dilemma Hiring an accountant for day-to-day bookkeeping sounds safe and convenient—but it’s not always effective. Every week, we hear from small business owners and nonprofits ...

Jan 14, 2026 11:01:23 AM

Read More

What on Earth is CAT Tax? If you’re a small business owner in Ohio, you’ve probably heard whispers about the Commercial Activity Tax (CAT). It’s a tax on gross receipts—essentially, the state’s way ...

Jan 8, 2026 9:16:00 AM

Read More

Even bookkeepers need a break from balance sheets. Unwinding, BudgetEase Style At BudgetEase, we love numbers—but we love recharging even more. After a full year of crunching numbers in 2025, we’re ...

Jan 5, 2026 2:56:29 PM

Read More

The new year is rolling along, but before you close the books on last year, your accountant needs a few key items to work their tax magic. The sooner you send them over, the better—especially if you ...

Jan 2, 2026 8:45:00 AM

Read More

At BudgetEase, we have the privilege of working with incredible organizations that make a real difference in their communities. One of those organizations is Therapeds, a team dedicated to helping ...

Dec 30, 2025 8:33:00 AM

Read More-4.png)

When your small business or nonprofit is thriving, tax season can feel like a buzzkill. But with the right strategies—and a solid bookkeeping service—you can reduce your tax burden and keep more of ...

Dec 18, 2025 9:54:00 AM

Read More

If you're a small business or nonprofit, tax season can feel like a surprise party you didn’t ask for. But with a little prep—and a reliable accounting service—you can turn chaos into clarity. ...

Dec 9, 2025 10:03:42 AM

Read More

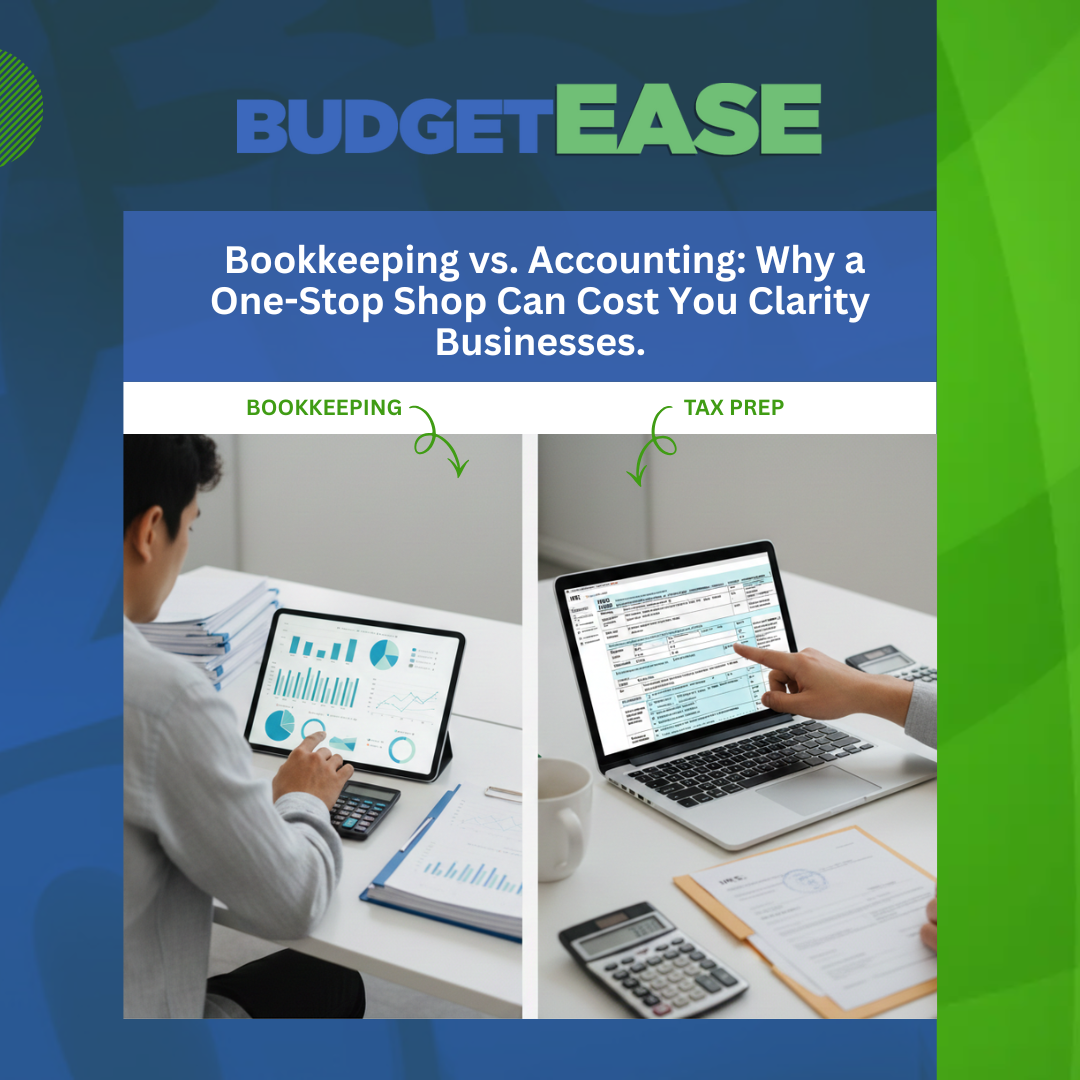

Bookkeeping vs. Accounting: Why the Distinction Matters Many businesses seek a one-stop solution for bookkeeping, tax planning, and tax preparation. While accountants are essential for tax strategy ...

Dec 1, 2025 8:47:00 AM

Read MoreSubscribe to Email Updates

Recent Posts

- How to Fix the Top 5 Accounting Challenges Nonprofits Face (With Practical Solutions)

- Client Spotlight Interview: Sterling Janitorial

- Custom Bookkeeping Solutions: Adapting Processes to Your Needs

- The Human Side of Bookkeeping: Why Communication Matters in Outsourced Accounting Services.

- Scaling a Small Business: Why Financial Readiness Matters More Than Growth

Posts by Tag

- Bookkeeping (275)

- Small Business (235)

- Financial Management (168)

- QuickBooks (140)

- small business bookkeeping (139)

- Profitability (107)

- QuickBooks Bookkeeping Company (100)

- Online Bookkeeping Services (97)

- Bookkeeping Companies (95)

- Cleveland Bookkeeping (94)

- For Accountants (69)

- Non-profit Bookkeeping (61)

- Non-Profit Accounting (51)

- Accounting (50)

- Virtual Bookkeeper (46)

- payroll (42)

- Virtual Bookkeeping Services (39)

- Budgeting (38)

- Nonprofit (36)

- Bookkeeper (34)

- Quick Books Online (30)

- Quickbooks Bookkeepers (23)

- Bookkeeping Catch Up Services (20)

- Business Finance (20)

- Efficienies (19)

- Bookkeeper Near Me (18)

- Client Spotlight (17)

- Outsourced Bookkeeping (17)

- Professional Services (15)

- Start-ups (15)

- BusinessGrowth (13)

- Video (13)

- eCommerce (13)

- Growth Mindset (11)

- Best Bookkeeper Near Me (9)

- Biotech (8)

- Cash Flow (8)

- QuickBooks Reports (8)

- Quickbooks Set Up Services (8)

- Tax Season (8)

- loan (8)

- Grow your Business (7)

- Balanced Income Statement (6)

- Banking (6)

- Efficiency (6)

- Financial Journey (6)

- Financial Mindset (6)

- Non Profit Finance (6)

- P&L Monthly (6)

- Quick Books Help (6)

- QuickBooks Online (6)

- Small Business Finance (6)

- Tax Filing (6)

- Year End Finance (6)

- nonprofit accounting (6)

- BudgetEase (5)

- Non-Profit Taxes (5)

- Reconciliations in QBO (5)

- Secure Bookkeeping (5)

- Small Business Taxes (5)

- Bookkeeping solutions (4)

- Digital Marketing (4)

- QuickBooks Catch-Up (4)

- Scam Alert (4)

- Scams (4)

- accounts receivable (4)

- quickbooks tips (4)

- 10k small businesses (3)

- Accounting for small business (3)

- Bookkeeping Support (3)

- Bookkeeping best practices (3)

- Business Sustainability (3)

- Cash Flow Statement (3)

- Entrepreneur (3)

- Financial Success (3)

- Fraud (3)

- How To Find A Bookkeeper (3)

- Non-Profit Donations (3)

- Profit (3)

- Protect from Fraud (3)

- Quick Books Catch Up (3)

- QuickBooks reconciliation (3)

- Save Time Hiring (3)

- Small Business Profit (3)

- Specialized Bookkeeping (3)

- Tax Preparation (3)

- Year End (3)

- Year End Accounting (3)

- financial clarity (3)

- A Bookkeepers Guide (2)

- ACH Payment (2)

- Accounting Made Easy (2)

- Accounting Tips (2)

- Accounting Transparency (2)

- Audit (2)

- Business Start-Up (2)

- Case Study (2)

- Cost Effective Solutions (2)

- Employee Retention (2)

- Financial management for nonprofits (2)

- Finding The Right Bookkeeper (2)

- Good Finance (2)

- Holiday Bookkeeping (2)

- Holiday Treats (2)

- How to Hire (2)

- In Kind Contributions (2)

- Incremental Improvement (2)

- Non-Profit Hiring (2)

- Outsource Smart (2)

- Profit and Loss (2)

- QBO Training (2)

- QuickBooks Loans (2)

- QuickBooks Review (2)

- Record Keeping (2)

- Small Business Financial Management (2)

- Small Business Hiring (2)

- Small Business Owner (2)

- Small Business efficiencies (2)

- Social Engineering (2)

- Year end planning (2)

- outsourced accounting services (2)

- tax planning (2)

- 1099s (1)

- 2025 Goals (1)

- 2025 Small Business Goals (1)

- AI for Accountants (1)

- AI for Bookkeepers (1)

- AI for Small Business (1)

- ATM (1)

- Academy Of Cleveland Ballet (1)

- Accounting Help (1)

- Accounting Process Improvement (1)

- Accounting security (1)

- Accounts Payable (1)

- Animal Rescue (1)

- BOI (1)

- Balance Sheet (1)

- Behavioral Health (1)

- Bench.com (1)

- Best Apps (1)

- Best Bookkeeper (1)

- Bill Pay (1)

- Bills (1)

- Bookkeeping Trends (1)

- Bounced Check (1)

- Budget (1)

- Budget vs Actual (1)

- Building Maintenance (1)

- Business Banking (1)

- Business Competition (1)

- Business Mentorship (1)

- BusinessOperations (1)

- Butterfly effect (1)

- CFO, Accountant or QBO Expert (1)

- COVID Loan (1)

- CPA (1)

- Cancel Subscriptions (1)

- Cash Flow Management (1)

- Cash Is King (1)

- CashFlow (1)

- Child Development (1)

- Child wellness (1)

- Clean Books (1)

- Clean Energy (1)

- Cleveland Ballet (1)

- Cleveland CPA (1)

- Cleveland Non-Profit (1)

- Client profitability (1)

- Closing your business (1)

- Commercial Cleaning (1)

- Communication in Bookkeeping (1)

- Community Development (1)

- Cost Savings Move (1)

- Credit Card Decline (1)

- Customized Financial Reporting (1)

- DIY Bookkeeping (1)

- Digital Receipts (1)

- Disaster Loan (1)

- Dog Boarding (1)

- Dog Daycare (1)

- Donations (1)

- Dues and Subscriptions (1)

- EIDL (1)

- Easy Budgeting (1)

- Economic Impact (1)

- Eliminating Costs (1)

- Facility Management (1)

- Family Business (1)

- FinCEn (1)

- Financial Confidence (1)

- Financial Reports (1)

- Financial Visibility (1)

- Financial fraud prevention (1)

- Financing (1)

- Find a Bookkeeper (1)

- Fiscal Agency (1)

- Fiscal Agents (1)

- Fiscal agent liability account (1)

- Future Of Transportation (1)

- Global Education (1)

- Government Grant (1)

- Grass Roots Accounting (1)

- Growing Business (1)

- Healthcare Innovation (1)

- Healthcare Partnerships (1)

- Healthcare Solutions (1)

- Hire A Bookkeeper (1)

- Hoarding Method (1)

- How to close my business (1)

- How to prepare your financial reports (1)

- In Kind Donations (1)

- Interest Rates (1)

- Intuit Assistant (1)

- K1 (1)

- Keep Receipts (1)

- Keeping Up With Your Bookkeeping (1)

- Lawyer Trust Accounts (1)

- Ledger (1)

- Loans (1)

- Mobility (1)

- Monthly Meetings (1)

- Moving Your Business (1)

- NIH Grant (1)

- NSF (1)

- Non-Profit Banking (1)

- Non-Profit Volunteer (1)

- Occupational Therapy (1)

- Office Cleaning (1)

- PayPal (1)

- Payment fees (1)

- Pediatric Therapy (1)

- Personal Budgeting (1)

- Personal Finance (1)

- Personal Tax for Small Business (1)

- Pet Adoption (1)

- Pet Parents (1)

- Point of Sale System (POS) (1)

- PreSchool Services (1)

- Pricing (1)

- Professional Cleaning (1)

- Profit First (1)

- Prosthetics (1)

- QBO AI (1)

- Quarterly Review (1)

- Quick Audit (1)

- QuickBooks Enterprise (1)

- QuickBooks Online Reporting (1)

- QuickBooks mistakes to avoid (1)

- QuickBooks scam (1)

- Quickbooks Bill Pay (1)

- Quicken (1)

- Receipts (1)

- Reconcile (1)

- Reporting (1)

- Restaurant Bookkeeping (1)

- Restaurant Finance (1)

- Retiring Bookkeeper (1)

- Return Item (1)

- Revenue (1)

- Saving Money (1)

- Scaling (1)

- Scaling a business (1)

- Small Business Closing (1)

- Small Business Debt (1)

- Small Business Invoicing (1)

- Small Business Quicken (1)

- Small Business Savings (1)

- Small Business Support (1)

- Small Businesses Planning (1)

- Software Engineering (1)

- Space Needs (1)

- Special Reports (1)

- Specialized (1)

- Speech Therapy (1)

- Square (1)

- Streamlining Processes (1)

- Success Tips (1)

- Sustainable Mobility (1)

- Tax Return Reconciliation (1)

- Taxes (1)

- The Power of One (1)

- TheraPeds (1)

- Therapy for Children (1)

- Timeless Bookkeeping (1)

- Toast (1)

- Volunteer Budget (1)

- Volunteer Management (1)

- Volunteers (1)

- What's New (1)

- Woman Owned Business (1)

- Women In Leadership (1)

- Work Smarter (1)

- Workflow Optimization (1)

- World Class Ballet (1)

- Year-end Bookkeeping (1)

- accounting communication (1)

- accounting support (1)

- arts education (1)

- arts-integrated learning (1)

- bank deposits (1)

- bookkeeping checklist (1)

- bookkeeping for non-profits (1)

- bookkeeping vs accounting (1)

- business strategy (1)

- clear financial reporting (1)

- coffee culture (1)

- community arts program (1)

- custom bookkeeping solutions (1)

- nonprofit arts education (1)

- nonprofit arts organization (1)

- stock donations (1)

- stress free bookkeeping (1)

- tailored bookkeeping services (1)

- team culture (1)

- youth arts program (1)