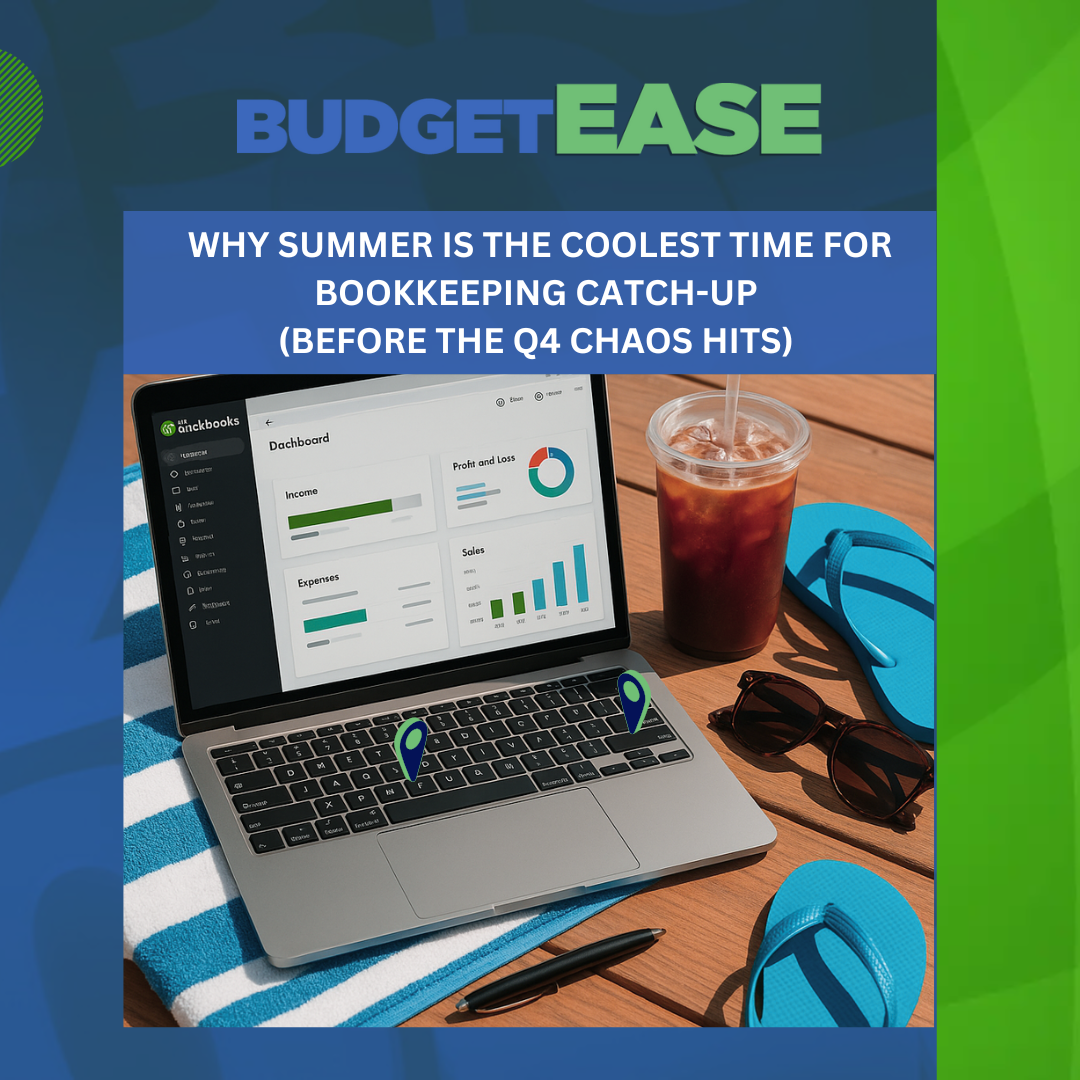

Summer: when the sun’s out, the iced coffee flows, and your QuickBooks bookkeeping is… still behind? Let’s fix that. While others are vacationing, smart small business owners and non-profits are ...

Jul 7, 2025 10:38:00 AM

Read More

The butterfly effect is real. One small shift in your bookkeeping setup can change the entire trajectory of your organization. Imagine if we hadn’t restructured our books to track the performance of ...

Jul 2, 2025 1:40:56 PM

Read More

Opening a second location is exciting—but it’s not just about ambition. It’s about arithmetic. Get Organized Before You Multiply Before you double your footprint, double-check your foundation. Is ...

Jun 26, 2025 11:38:12 AM

Read More

The Quiet Backbone of the Office In many small businesses and nonprofits, the bookkeeper is the person who keeps the financial wheels turning quietly, efficiently, and often without much fanfare. ...

Jun 24, 2025 11:40:14 AM

Read More

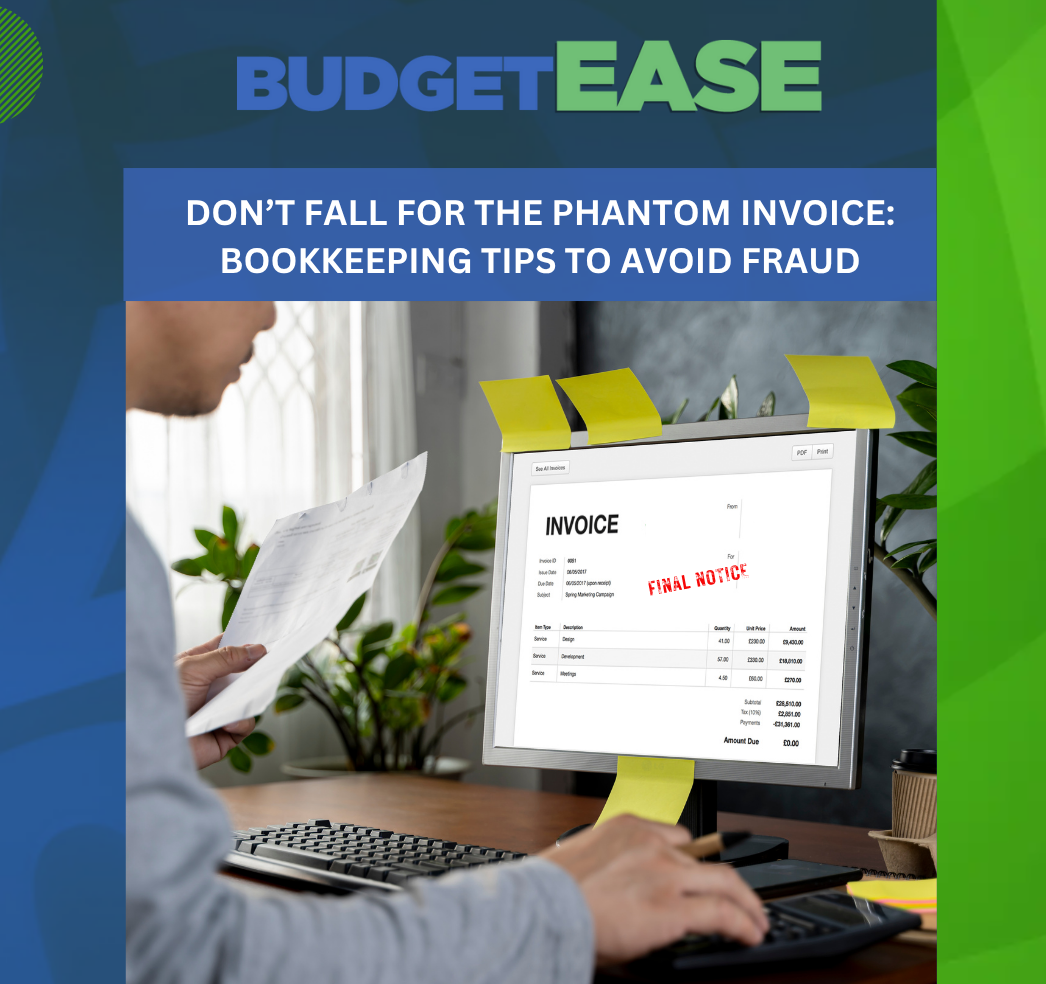

You’re sipping your coffee, checking emails, and there it is—an invoice from a vendor you think you remember. It’s got a logo, a due date, and a passive-aggressive “Final Notice.” You panic. You pay ...

Jun 20, 2025 3:44:08 PM

Read More

The Temptation to Look Away Let’s be honest—when your small business or nonprofit is going through a rough patch, the last thing you want to do is open QuickBooks and face the music. But here’s the ...

Jun 4, 2025 1:48:32 PM

Read More

Why Cash Flow is King (and Queen) Whether you're running a small business or managing a nonprofit, tracking cash flow is non-negotiable. Cash flow is the lifeblood of your operation—without it, your ...

May 27, 2025 2:10:23 PM

Read More

At BudgetEase, we pride ourselves on being technology savvy and always on the lookout for tools that can enhance our productivity and make our lives easier. Here are a few of our favorite apps that ...

May 21, 2025 6:45:28 PM

Read More

No one should ever experience what I recently heard during a recent call from the Police. I received a call asking for information about someone that was being investigated. My name came up in their ...

May 20, 2025 11:03:32 AM

Read More

Introduction: The EIDL Loan Welcome to the world of Economic Injury Disaster Loans (EIDL)! These loans, provided by the US Small Business Administration (SBA) during the COVID-19 pandemic, were a ...

May 20, 2025 10:43:41 AM

Read MoreSubscribe to Email Updates

Recent Posts

- Restaurant Bookkeeping Made Simple: How Smart Accounting Keeps Your Kitchen Profitable.

- Why Monthly Bookkeeping Meetings Matter (And Why They’re Surprisingly Fun).

- Client Spotlight Interview: Leimkuehler, Inc.

- Part 2 - Employee Turnover Is Costing Small Businesses Big—Here’s How Smarter Hiring Can Fix It.

- Part 1 - Employee Turnover Is Costing Small Businesses Big—Here’s How Smarter Hiring Can Fix It.

Posts by Tag

- Bookkeeping (252)

- Small Business (213)

- Financial Management (149)

- QuickBooks (134)

- small business bookkeeping (115)

- Profitability (92)

- Cleveland Bookkeeping (80)

- Online Bookkeeping Services (79)

- QuickBooks Bookkeeping Company (79)

- Bookkeeping Companies (73)

- For Accountants (67)

- Accounting (48)

- payroll (40)

- Budgeting (38)

- Non-profit Bookkeeping (38)

- Non-Profit Accounting (34)

- Nonprofit (33)

- Virtual Bookkeeping Services (31)

- Virtual Bookkeeper (27)

- Bookkeeper (19)

- Quick Books Online (19)

- Business Finance (17)

- Client Spotlight (15)

- Professional Services (15)

- Quickbooks Bookkeepers (15)

- Start-ups (15)

- Outsourced Bookkeeping (13)

- Video (13)

- eCommerce (13)

- Bookkeeper Near Me (12)

- Efficienies (12)

- Bookkeeping Catch Up Services (10)

- BusinessGrowth (10)

- Biotech (8)

- Cash Flow (8)

- Growth Mindset (8)

- Quickbooks Set Up Services (8)

- loan (7)

- Balanced Income Statement (6)

- Best Bookkeeper Near Me (6)

- Financial Journey (6)

- Financial Mindset (6)

- Grow your Business (6)

- P&L Monthly (6)

- Banking (5)

- Efficiency (5)

- Quick Books Help (5)

- Reconciliations in QBO (5)

- Secure Bookkeeping (5)

- Digital Marketing (4)

- Small Business Finance (4)

- accounts receivable (4)

- Business Sustainability (3)

- Cash Flow Statement (3)

- Entrepreneur (3)

- Fraud (3)

- Non-Profit Taxes (3)

- Profit (3)

- Protect from Fraud (3)

- Quick Books Catch Up (3)

- Scam Alert (3)

- Scams (3)

- Small Business Taxes (3)

- Tax Filing (3)

- Tax Season (3)

- A Bookkeepers Guide (2)

- Accounting Made Easy (2)

- Accounting Tips (2)

- Accounting Transparency (2)

- Bookkeeping Support (2)

- BudgetEase (2)

- Business Start-Up (2)

- Case Study (2)

- Cost Effective Solutions (2)

- Employee Retention (2)

- Good Finance (2)

- How to Hire (2)

- In Kind Contributions (2)

- Incremental Improvement (2)

- Non Profit Finance (2)

- Non-Profit Donations (2)

- Non-Profit Hiring (2)

- Outsource Smart (2)

- QBO Training (2)

- QuickBooks Review (2)

- Save Time Hiring (2)

- Small Business Financial Management (2)

- Small Business Hiring (2)

- Small Business Profit (2)

- Social Engineering (2)

- Year End (2)

- Year End Finance (2)

- 1099s (1)

- 10k small businesses (1)

- 2025 Goals (1)

- 2025 Small Business Goals (1)

- ACH Payment (1)

- AI for Accountants (1)

- AI for Bookkeepers (1)

- AI for Small Business (1)

- Academy Of Cleveland Ballet (1)

- Animal Rescue (1)

- Audit (1)

- BOI (1)

- Balance Sheet (1)

- Bench.com (1)

- Best Apps (1)

- Bookkeeping solutions (1)

- Bounced Check (1)

- Budget (1)

- Business Competition (1)

- Business Mentorship (1)

- BusinessOperations (1)

- Butterfly effect (1)

- CFO, Accountant or QBO Expert (1)

- COVID Loan (1)

- CPA (1)

- Cancel Subscriptions (1)

- Cash Is King (1)

- CashFlow (1)

- Clean Books (1)

- Cleveland Ballet (1)

- Cleveland CPA (1)

- Cleveland Non-Profit (1)

- Closing your business (1)

- Community Development (1)

- Cost Savings Move (1)

- Credit Card Decline (1)

- DIY Bookkeeping (1)

- Digital Receipts (1)

- Disaster Loan (1)

- Donations (1)

- Dues and Subscriptions (1)

- EIDL (1)

- Economic Impact (1)

- Eliminating Costs (1)

- Family Business (1)

- FinCEn (1)

- Financial Confidence (1)

- Financial Reports (1)

- Financial Success (1)

- Financial Visibility (1)

- Financial management for nonprofits (1)

- Financing (1)

- Finding The Right Bookkeeper (1)

- Fiscal Agency (1)

- Fiscal Agents (1)

- Fiscal agent liability account (1)

- Global Education (1)

- Government Grant (1)

- Grass Roots Accounting (1)

- Growing Business (1)

- Healthcare Innovation (1)

- Healthcare Solutions (1)

- Hoarding Method (1)

- How To Find A Bookkeeper (1)

- How to close my business (1)

- How to prepare your financial reports (1)

- In Kind Donations (1)

- Interest Rates (1)

- Intuit Assistant (1)

- K1 (1)

- Keep Receipts (1)

- Keeping Up With Your Bookkeeping (1)

- Lawyer Trust Accounts (1)

- Ledger (1)

- Loans (1)

- Mobility (1)

- Monthly Meetings (1)

- Moving Your Business (1)

- NIH Grant (1)

- NSF (1)

- Non-Profit Volunteer (1)

- PayPal (1)

- Payment fees (1)

- Pet Adoption (1)

- Pricing (1)

- Profit First (1)

- Profit and Loss (1)

- Prosthetics (1)

- QBO AI (1)

- Quarterly Review (1)

- QuickBooks Loans (1)

- QuickBooks Reports (1)

- Quicken (1)

- Receipts (1)

- Reconcile (1)

- Record Keeping (1)

- Return Item (1)

- Revenue (1)

- Saving Money (1)

- Small Business Closing (1)

- Small Business Debt (1)

- Small Business Invoicing (1)

- Small Business Owner (1)

- Small Business Quicken (1)

- Small Business Savings (1)

- Small Business efficiencies (1)

- Small Businesses Planning (1)

- Software Engineering (1)

- Space Needs (1)

- Streamlining Processes (1)

- Success Tips (1)

- The Power of One (1)

- Timeless Bookkeeping (1)

- Volunteer Budget (1)

- Volunteer Management (1)

- Volunteers (1)

- Women In Leadership (1)

- Work Smarter (1)

- World Class Ballet (1)